Coinsurance is a cost-sharing provision in health insurance that requires the insured to pay a percentage of the costs of covered healthcare services, typically after the deductible has been met. The coinsurance percentage is usually expressed as a ratio, such as 80/20 or 90/10. This means that the insurance company will pay 80% or 90% of the costs, and the insured will pay the remaining 20% or 10%.

Coinsurance is different from a copayment, which is a fixed dollar amount that the insured pays for a specific service, such as a doctor’s visit or prescription drug. Coinsurance is also different from a deductible, which is the amount that the insured must pay out-of-pocket before the insurance company begins to pay for covered services.

Coinsurance can help to reduce the overall cost of health insurance premiums. However, it is important to understand how coinsurance works before choosing a health insurance plan. If you have a high coinsurance percentage, you may have to pay more out-of-pocket for healthcare services.

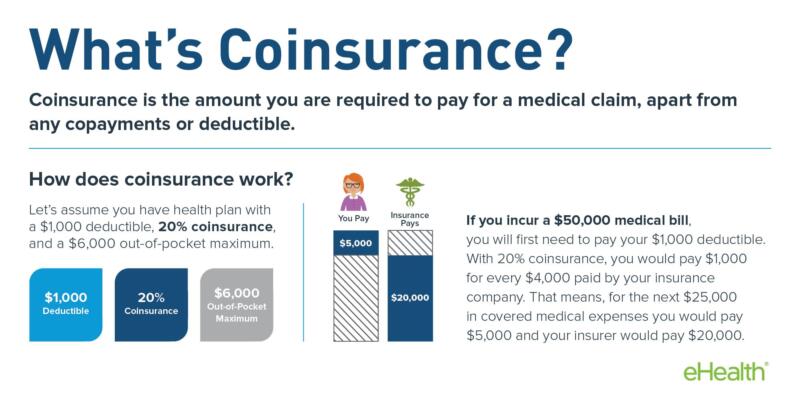

Here is an example of how coinsurance works:

- You have a health insurance plan with an 80/20 coinsurance provision.

- You visit the doctor and the bill is $100.

- You have already met your deductible, so your insurance company will pay 80% of the bill, which is $80.

- You will be responsible for paying the remaining 20%, which is $20.

Coinsurance can be a significant expense, especially if you have a high coinsurance percentage. However, there are ways to reduce the cost of coinsurance, such as choosing a health insurance plan with a lower coinsurance percentage or negotiating with your healthcare providers.

What is coinsurance in health insurance?

Coinsurance is a cost-sharing provision in health insurance that requires the insured to pay a percentage of the costs of covered healthcare services, typically after the deductible has been met. The coinsurance percentage is usually expressed as a ratio, such as 80/20 or 90/10. This means that the insurance company will pay 80% or 90% of the costs, and the insured will pay the remaining 20% or 10%.

How does coinsurance work?

Coinsurance is applied to the cost of covered healthcare services after the deductible has been met. For example, if you have a health insurance plan with an 80/20 coinsurance provision and you visit the doctor, you will be responsible for paying 20% of the cost of the visit. If the doctor’s visit costs $100, you will pay $20 and your insurance company will pay $80.

What is the difference between coinsurance and a copayment?

A copayment is a fixed dollar amount that the insured pays for a specific service, such as a doctor’s visit or prescription drug. Coinsurance, on the other hand, is a percentage of the cost of covered healthcare services.

What is the difference between coinsurance and a deductible?

A deductible is the amount that the insured must pay out-of-pocket before the insurance company begins to pay for covered services. Coinsurance, on the other hand, is the percentage of the cost of covered healthcare services that the insured is responsible for paying after the deductible has been met.

How can I reduce the cost of coinsurance?

There are a few ways to reduce the cost of coinsurance:

- Choose a health insurance plan with a lower coinsurance percentage.

- Negotiate with your healthcare providers to reduce the cost of services.

- Use a health savings account (HSA) to pay for healthcare expenses.

What is coinsurance in health insurance?

Coinsurance is a cost-sharing provision in health insurance that requires the insured to pay a percentage of the costs of covered healthcare services, typically after the deductible has been met. The coinsurance percentage is usually expressed as a ratio, such as 80/20 or 90/10. This means that the insurance company will pay 80% or 90% of the costs, and the insured will pay the remaining 20% or 10%.

Coinsurance can be a significant expense, especially if you have a high coinsurance percentage. However, there are ways to reduce the cost of coinsurance, such as choosing a health insurance plan with a lower coinsurance percentage or negotiating with your healthcare providers.

FAQ

What is coinsurance in health insurance?

Coinsurance is a cost-sharing provision in health insurance that requires the insured to pay a percentage of the costs of covered healthcare services, typically after the deductible has been met. The coinsurance percentage is usually expressed as a ratio, such as 80/20 or 90/10. This means that the insurance company will pay 80% or 90% of the costs, and the insured will pay the remaining 20% or 10%.

How does coinsurance work?

Coinsurance is applied to the cost of covered healthcare services after the deductible has been met. For example, if you have a health insurance plan with an 80/20 coinsurance provision and you visit the doctor, you will be responsible for paying 20% of the cost of the visit. If the doctor’s visit costs $100, you will pay $20 and your insurance company will pay $80.

What is the difference between coinsurance and a copayment?

A copayment is a fixed dollar amount that the insured pays for a specific service, such as a doctor’s visit or prescription drug. Coinsurance, on the other hand, is a percentage of the cost of covered healthcare services.

What is the difference between coinsurance and a deductible?

A deductible is the amount that the insured must pay out-of-pocket before the insurance company begins to pay for covered services. Coinsurance, on the other hand, is the percentage of the cost of covered healthcare services that the insured is responsible for paying after the deductible has been met.

How can I reduce the cost of coinsurance?

There are a few ways to reduce the cost of coinsurance:

- Choose a health insurance plan with a lower coinsurance percentage.

- Negotiate with your healthcare providers to reduce the cost of services.

- Use a health savings account (HSA) to pay for healthcare expenses.

What if I can’t afford to pay my coinsurance?

If you can’t afford to pay your coinsurance, you may be able to get help from your state’s Medicaid program. Medicaid is a government program that provides health insurance to low-income individuals and families.

What is coinsurance in health insurance?

Coinsurance is a cost-sharing provision in health insurance that requires the insured to pay a percentage of the costs of covered healthcare services, typically after the deductible has been met. The coinsurance percentage is usually expressed as a ratio, such as 80/20 or 90/10. This means that the insurance company will pay 80% or 90% of the costs, and the insured will pay the remaining 20% or 10%.

Conclusion

Coinsurance is a cost-sharing provision in health insurance that requires the insured to pay a percentage of the costs of covered healthcare services, typically after the deductible has been met. Coinsurance can be a significant expense, especially if you have a high coinsurance percentage. However, there are ways to reduce the cost of coinsurance, such as choosing a health insurance plan with a lower coinsurance percentage or negotiating with your healthcare providers.

If you are struggling to afford your coinsurance, you may be able to get help from your state’s Medicaid program. Medicaid is a government program that provides health insurance to low-income individuals and families.

For more information on coinsurance, please visit the website of the Centers for Medicare & Medicaid Services (CMS): https://www.cms.gov/

Invitation to comment and share

Please share your thoughts on coinsurance in the comments section below. Have you ever had to pay coinsurance? How did you reduce the cost of your coinsurance?

I encourage you to share this article with your friends and family on social media. The more people who understand coinsurance, the better equipped they will be to make informed decisions about their health insurance coverage.