Local Residents - Enter ZIP Code Get Free Health Insurance Quotes. Find Best Deals - Local Residents Save New 2025 Health Insurance Plans.

Apply and enroll a Marketplace plan an approved enrollment partner, an insurance company online health insurance seller. Find partner. Fill and mail a paper application. You'll get eligibility results the mail 2 weeks.

Apply and enroll a Marketplace plan an approved enrollment partner, an insurance company online health insurance seller. Find partner. Fill and mail a paper application. You'll get eligibility results the mail 2 weeks.

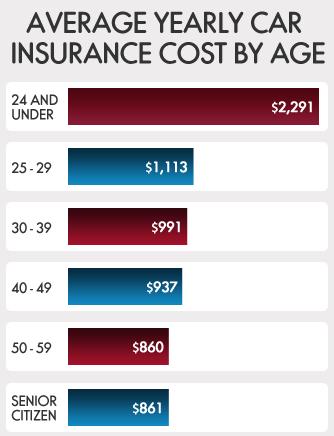

The amount pay your health insurance depend where live, income, the size your household. Health insurance costs include premium, is you pay your insurance plan month. But, you seek health care services, may have pay out-of-pocket costs.

The amount pay your health insurance depend where live, income, the size your household. Health insurance costs include premium, is you pay your insurance plan month. But, you seek health care services, may have pay out-of-pocket costs.

Get applying picking plan Open Enrollment ends January 15. Pay first premium your insurance company start 2025 coverage Learn how check your plan coverage started how get your plan's website pay premium.

Get applying picking plan Open Enrollment ends January 15. Pay first premium your insurance company start 2025 coverage Learn how check your plan coverage started how get your plan's website pay premium.

Most pre-retirement Americans get health insurance their employer there other ways get coverage your company doesn't offer insurance you're of work. Ways Get .

Most pre-retirement Americans get health insurance their employer there other ways get coverage your company doesn't offer insurance you're of work. Ways Get .

Use ACA's Health Insurance Marketplace find affordable health insurance options. Learn COBRA insurance how get coverage COBRA, Consolidated Omnibus Budget Reconciliation Act, lets qualified workers their group health insurance a limited time a change eligibility.

Use ACA's Health Insurance Marketplace find affordable health insurance options. Learn COBRA insurance how get coverage COBRA, Consolidated Omnibus Budget Reconciliation Act, lets qualified workers their group health insurance a limited time a change eligibility.

Find individual family health insurance plans your area. Get quotes, get finding plan, learn about health insurance options.

Find individual family health insurance plans your area. Get quotes, get finding plan, learn about health insurance options.

In addition, CHIP (Children's Health Insurance Program) enrollment also year-round, eligibility extends higher income levels Medicaid. good news that your application successful, Medicaid coverage be effective on date the application the day the month you apply.And e ven news some applicants: .

In addition, CHIP (Children's Health Insurance Program) enrollment also year-round, eligibility extends higher income levels Medicaid. good news that your application successful, Medicaid coverage be effective on date the application the day the month you apply.And e ven news some applicants: .

Option 3: Buy From Insurer . Health Insurance Marketplace not include health insurance plan available. people be to find plan better meets .

Option 3: Buy From Insurer . Health Insurance Marketplace not include health insurance plan available. people be to find plan better meets .

With medical costs the rise, single health emergency cause significant financial hardship you're uninsured. 2022, 92.1% Americans health insurance some point, from 91.7% 2021, reflecting growing awareness the importance being insured. Affordable Care Act (ACA), commonly as Obamacare, transformed access health insurance the by .

With medical costs the rise, single health emergency cause significant financial hardship you're uninsured. 2022, 92.1% Americans health insurance some point, from 91.7% 2021, reflecting growing awareness the importance being insured. Affordable Care Act (ACA), commonly as Obamacare, transformed access health insurance the by .

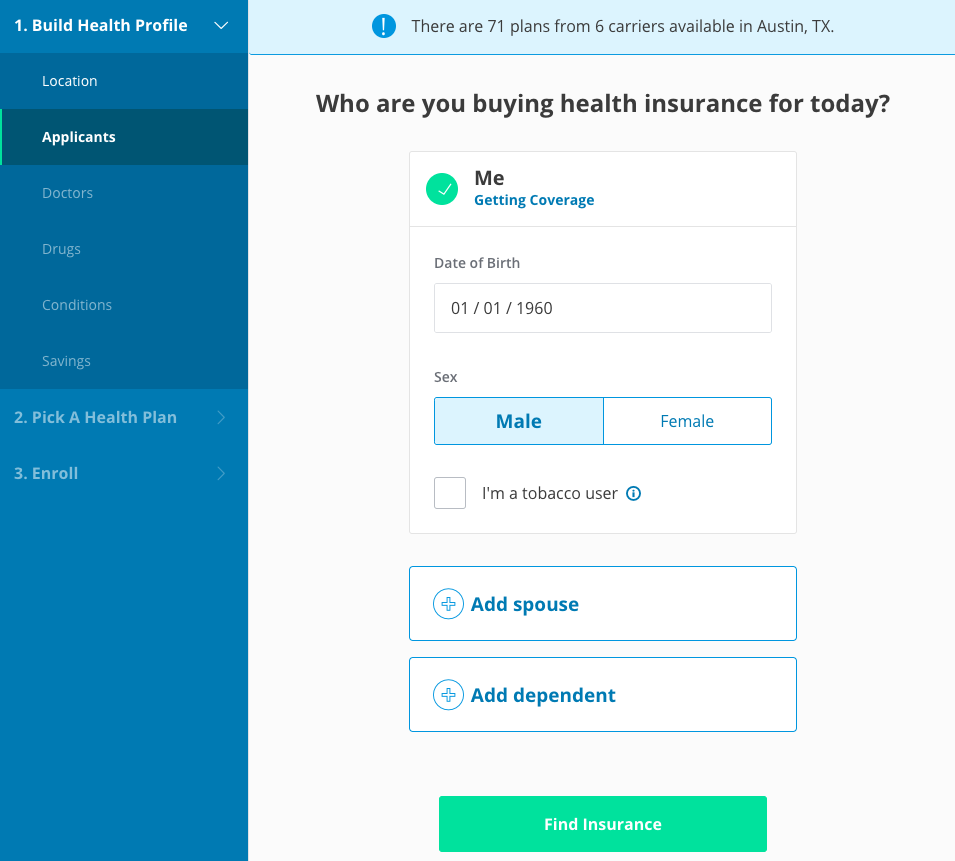

ACA enrollment involves completing application, choosing plan, paying first premium, needed. place start HealthCare.gov, national health plan marketplace website.At top, click "Get Coverage" select state. states the national marketplace system applications. other states Washington, D.C. run own marketplaces.

ACA enrollment involves completing application, choosing plan, paying first premium, needed. place start HealthCare.gov, national health plan marketplace website.At top, click "Get Coverage" select state. states the national marketplace system applications. other states Washington, D.C. run own marketplaces.

How to Get Health Insurance (Health Insurance 3/3) - YouTube

How to Get Health Insurance (Health Insurance 3/3) - YouTube

How to Get Health Insurance - Ramsey

How to Get Health Insurance - Ramsey

How do I get health insurance without a job? - YouTube

How do I get health insurance without a job? - YouTube

How To Get Health Insurance? | InternetTips24

How To Get Health Insurance? | InternetTips24

A guide on how to get a health insurance

A guide on how to get a health insurance

PPT - Stay Informed! PowerPoint Presentation, free download - ID:1676039

PPT - Stay Informed! PowerPoint Presentation, free download - ID:1676039

Business Basics: How Do I Get Health Insurance? - Synovus

Business Basics: How Do I Get Health Insurance? - Synovus

How to get Health Insurance for Mental Health - Life Skills Village

How to get Health Insurance for Mental Health - Life Skills Village

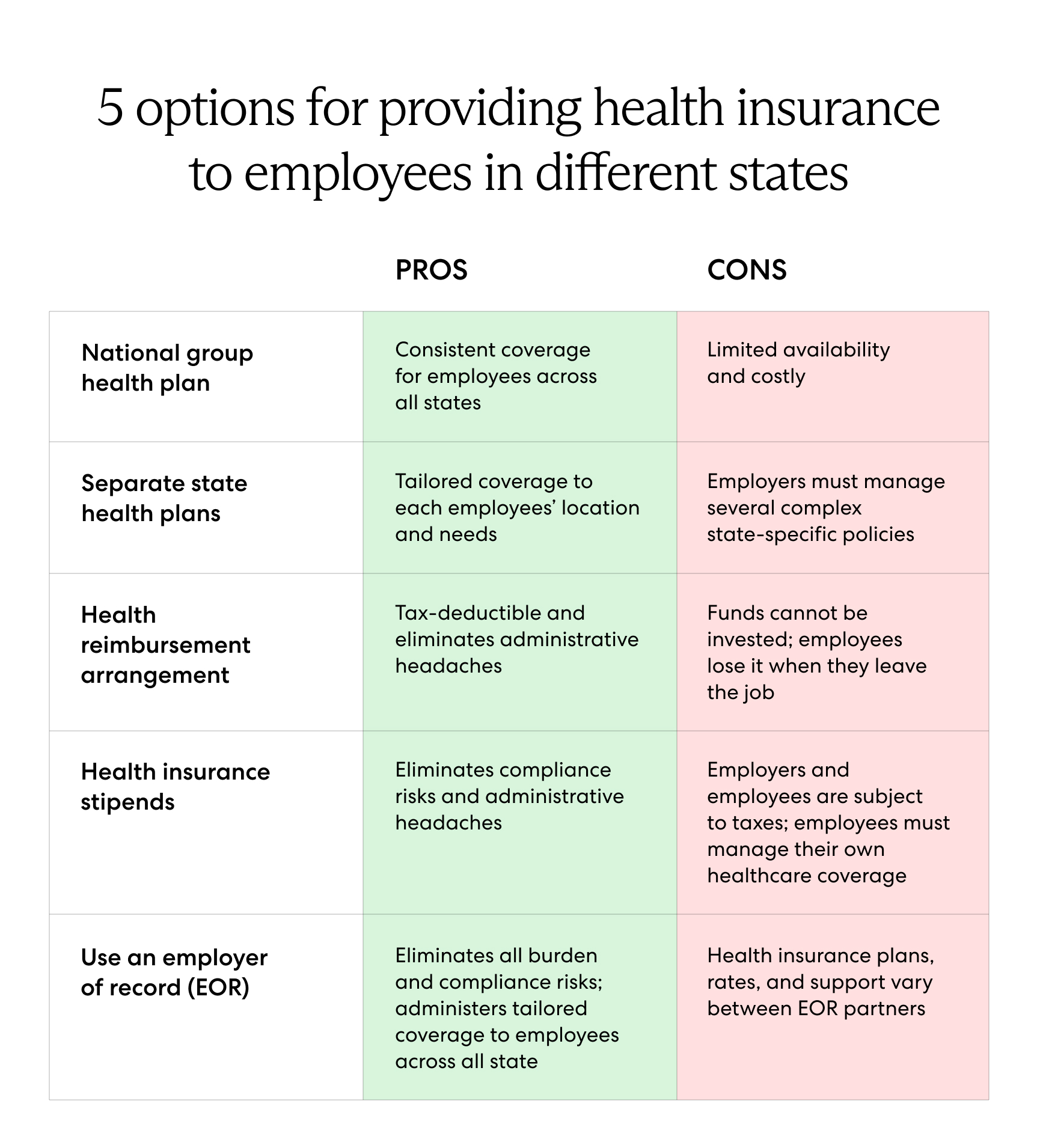

How to Provide Health Insurance for Employees in Different States

How to Provide Health Insurance for Employees in Different States

The Best Way To Get Medical Insurance - A Comprehensive Guide

The Best Way To Get Medical Insurance - A Comprehensive Guide