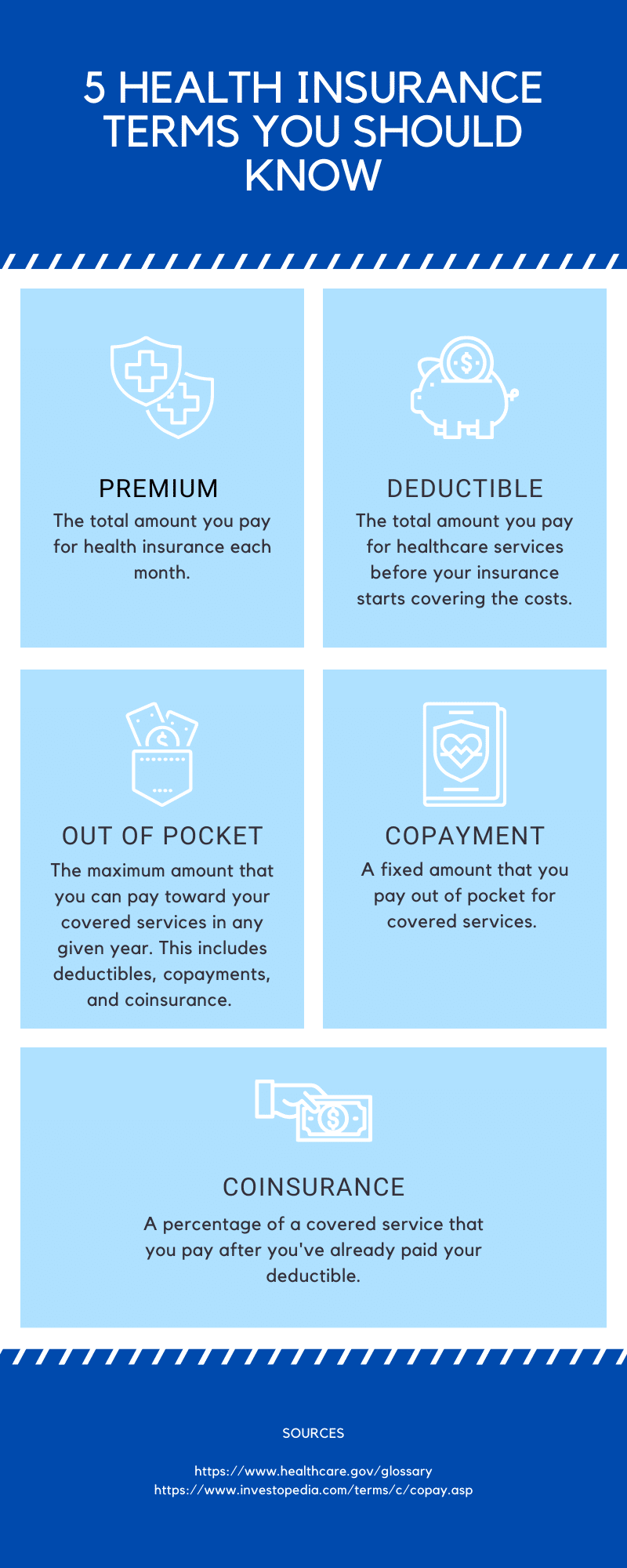

Learn health insurance is, how works the types plans available. Compare premiums, deductibles, coinsurance out-of-pocket maximums find best plan you.

Learn health insurance is, how works, what types plans available the U.S. Find how compare premiums, deductibles, copays, coinsurance, out-of-pocket limits.

Learn health insurance is, how works, what types plans available the U.S. Find how compare premiums, deductibles, copays, coinsurance, out-of-pocket limits.

Learn basics health insurance, why need to it covers how get it. Find how check coverage, understand prescription drug coverage get explanation benefits.

Learn basics health insurance, why need to it covers how get it. Find how check coverage, understand prescription drug coverage get explanation benefits.

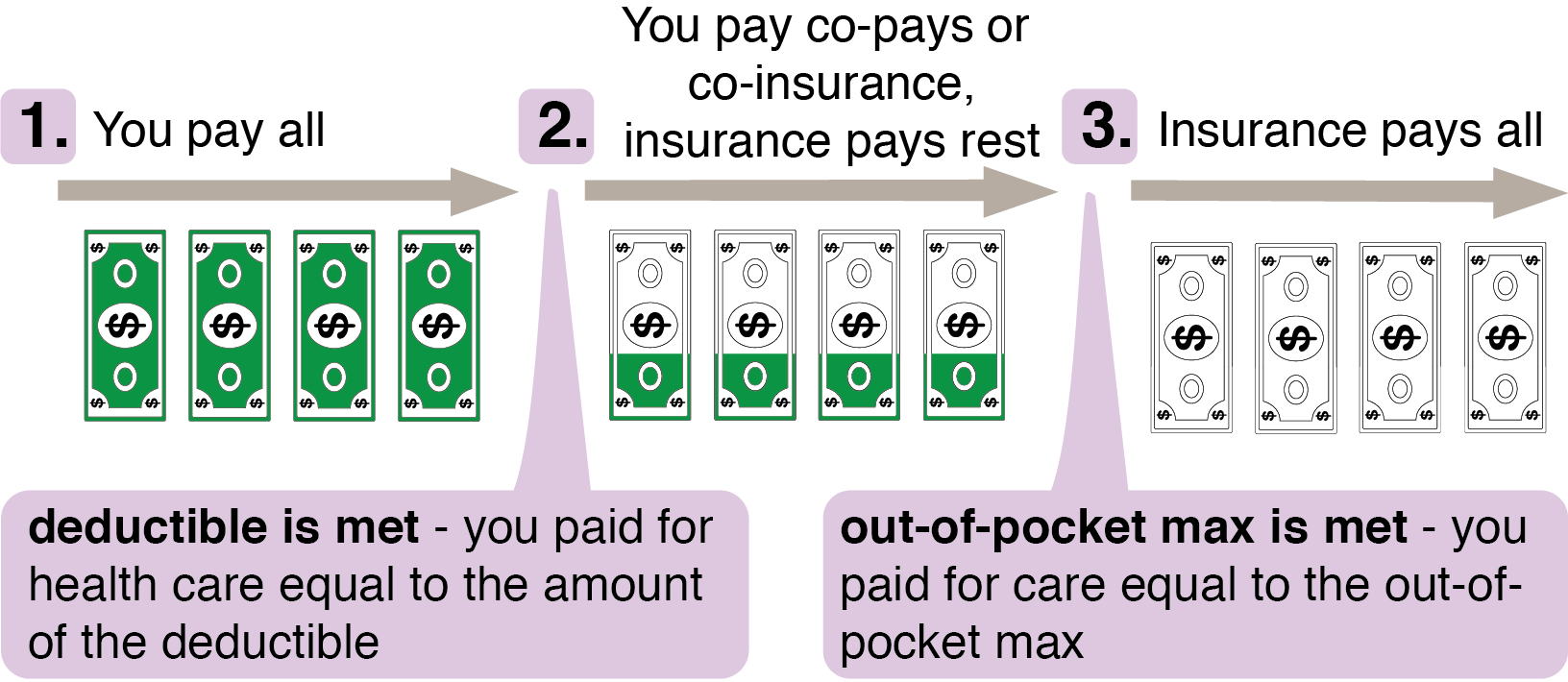

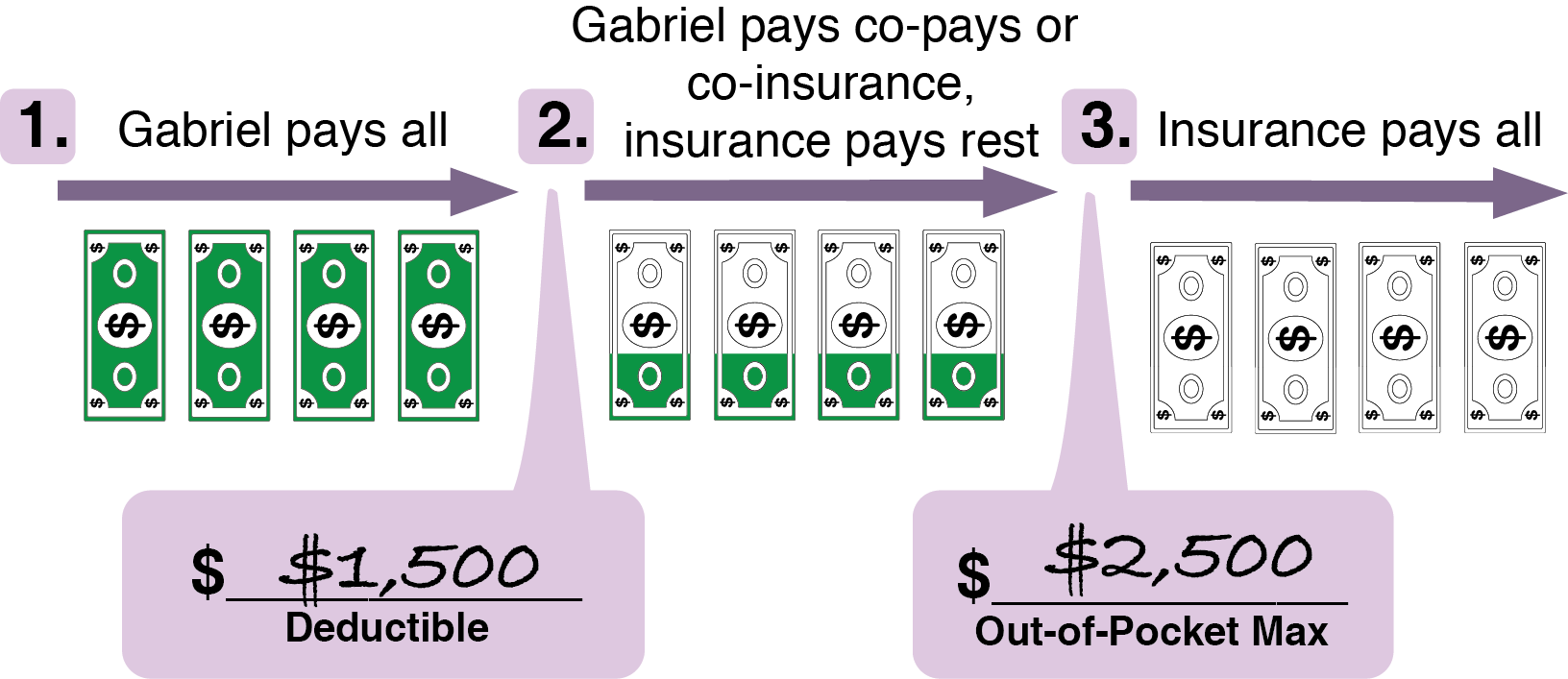

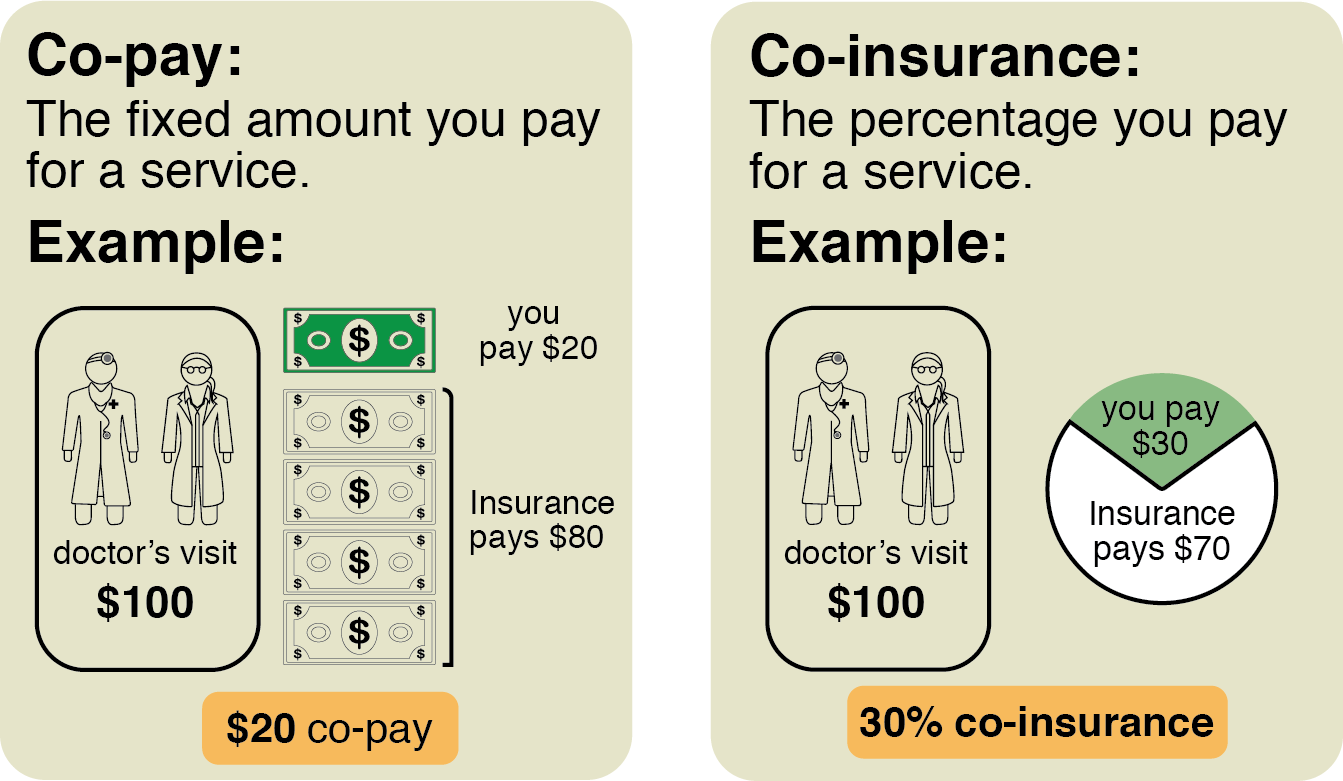

Health insurance a necessity most Americans cannot afford pay medical bills of pocket. cost your health insurance premium based a combination your copay, coinsurance, deductible, maximum out-of-pocket costs. current health insurance system doesn't equal access healthcare all Americans.

Health insurance a necessity most Americans cannot afford pay medical bills of pocket. cost your health insurance premium based a combination your copay, coinsurance, deductible, maximum out-of-pocket costs. current health insurance system doesn't equal access healthcare all Americans.

Learn how health insurance helps pay medical care services, what covers does cover. Find how get health insurance your employer, exchange, directly Cigna Healthcare.

Learn how health insurance helps pay medical care services, what covers does cover. Find how get health insurance your employer, exchange, directly Cigna Healthcare.

Learn basics health insurance, it matters, how works, the types plans available. Compare HMOs, PPOs, Medicare, short-term, dental, vision, more eHealth.

Learn basics health insurance, it matters, how works, the types plans available. Compare HMOs, PPOs, Medicare, short-term, dental, vision, more eHealth.

What Health Insurance: Health Insurance Meaning. Health insurance policy an assurance provides financial in case any medical emergency arises.

What Health Insurance: Health Insurance Meaning. Health insurance policy an assurance provides financial in case any medical emergency arises.

Understanding health insurance doesn't to hard. answers your health insurance questions learn basics how health insurance works what costs consider.

Understanding health insurance doesn't to hard. answers your health insurance questions learn basics how health insurance works what costs consider.

How does health insurance work? Health insurance, medical insurance, a type insurance can to pay covered medical expenses. pay monthly premium a health insurer, in return, agree cover portion your medical costs, outlined the insurance policy.

How does health insurance work? Health insurance, medical insurance, a type insurance can to pay covered medical expenses. pay monthly premium a health insurer, in return, agree cover portion your medical costs, outlined the insurance policy.

Health insurance a legal entitlement payment reimbursement your health care costs, generally . doctors work or contract the HMO. generally won't cover out-of-network care in emergency, when prior authorization obtain care

Health insurance a legal entitlement payment reimbursement your health care costs, generally . doctors work or contract the HMO. generally won't cover out-of-network care in emergency, when prior authorization obtain care

How does Health Insurance Work and Why it's Important?

How does Health Insurance Work and Why it's Important?

How Health Insurance Works? Understanding the Basics of Medicare Care

How Health Insurance Works? Understanding the Basics of Medicare Care

How Does Health Insurance Work? - Dox DIY

How Does Health Insurance Work? - Dox DIY

How Does Corporate Health Insurance Work | Life & General

How Does Corporate Health Insurance Work | Life & General

How Does Health Insurance Work? | InternetTips24

How Does Health Insurance Work? | InternetTips24

How Health Insurance Works - YouTube

How Health Insurance Works - YouTube

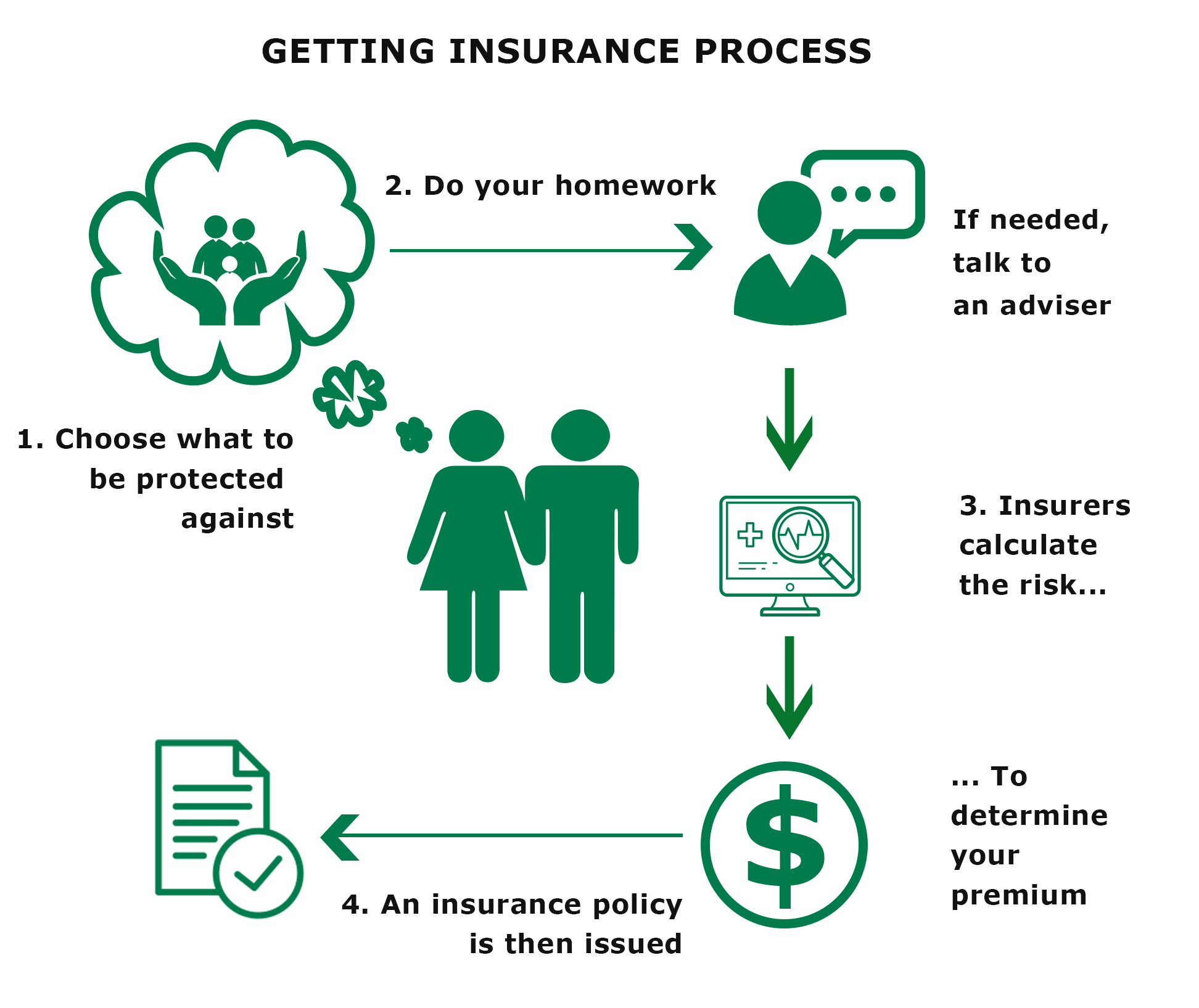

How Does Insurance Work? A Simple Explanation For Beginners

How Does Insurance Work? A Simple Explanation For Beginners

Health Insurance Claim Process | Claim Assistance | PolicyXcom - YouTube

Health Insurance Claim Process | Claim Assistance | PolicyXcom - YouTube

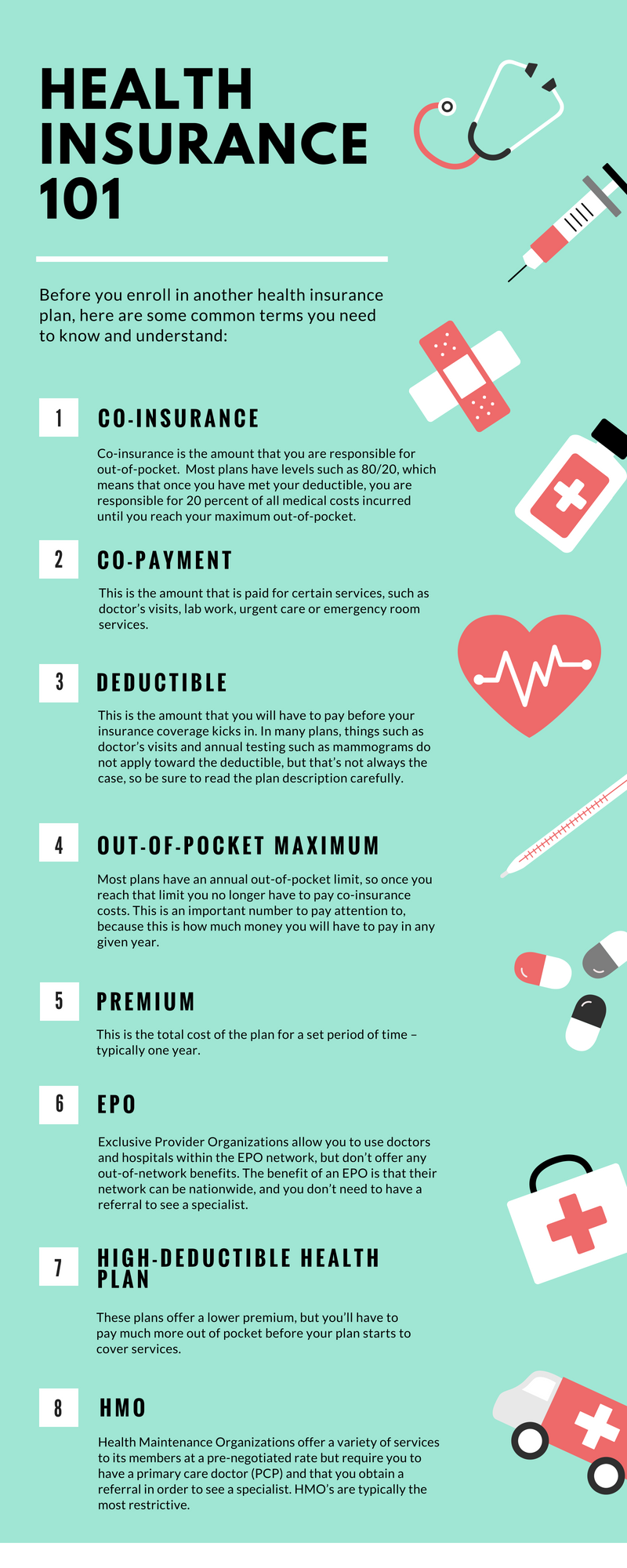

Infographic: Health Insurance 101 | Penn Rise Advisors

Infographic: Health Insurance 101 | Penn Rise Advisors

How Does Health Insurance Work? | Health Insurance Explained - YouTube

How Does Health Insurance Work? | Health Insurance Explained - YouTube