Enroll Today - Compare Top Health Insurance Plans Your State & Save. Explore Healthcare Rates. The 2025 Insurance Your Needs

Discover KP Difference Quality Care, Affordable Plans & Choice Doctors. Select Affordable High Quality Health Care Plan KP.

Discover KP Difference Quality Care, Affordable Plans & Choice Doctors. Select Affordable High Quality Health Care Plan KP.

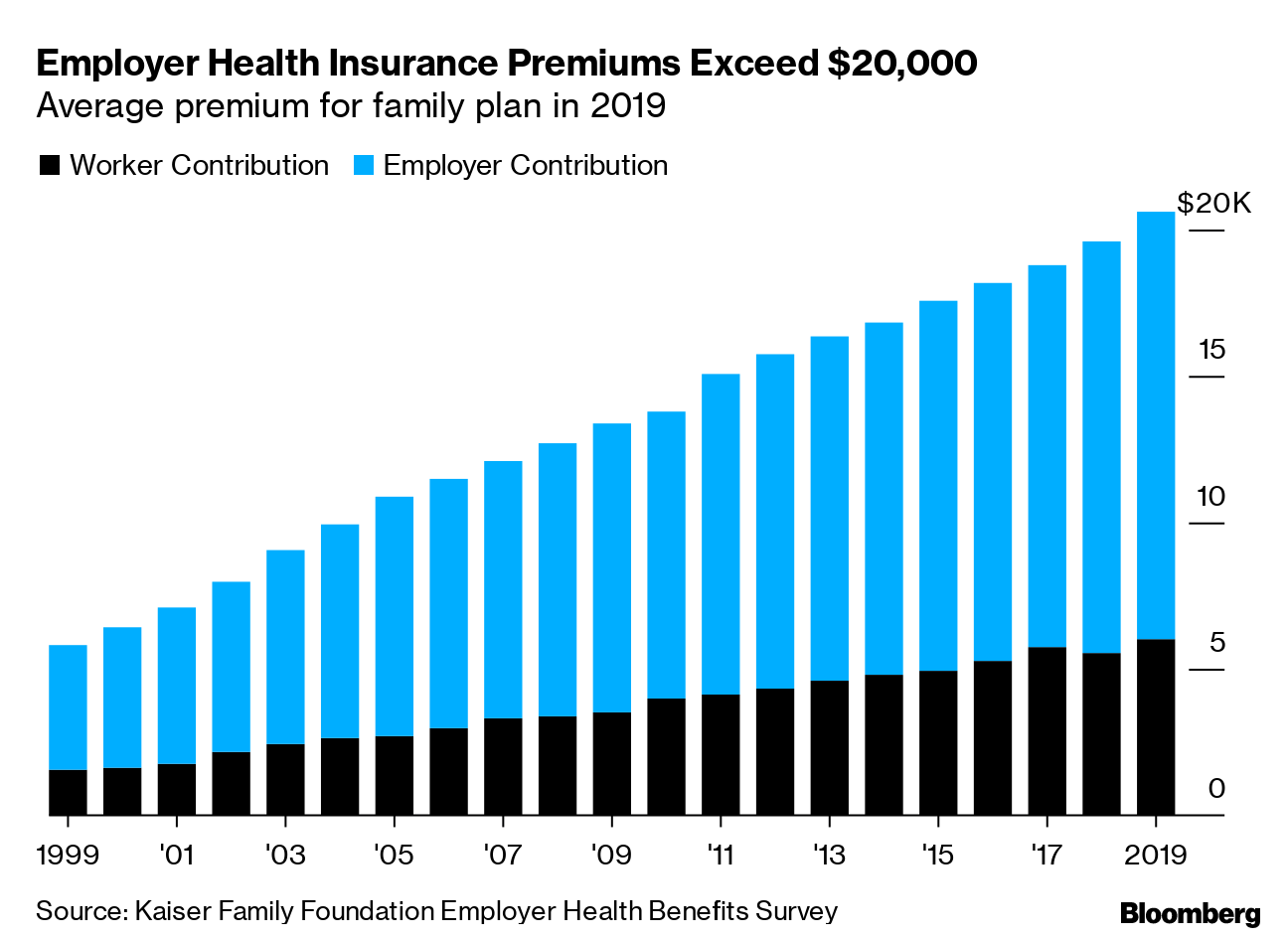

For family, average health insurance premium cost $25,572 2024, combining employer family contributions, to KFF. Premiums increased half 2014. Premiums .

For family, average health insurance premium cost $25,572 2024, combining employer family contributions, to KFF. Premiums increased half 2014. Premiums .

The cost family health insurance jumped 7% the consecutive year a decade more modest yearly increases. Family insurance rates increased just 1% 2022.

The cost family health insurance jumped 7% the consecutive year a decade more modest yearly increases. Family insurance rates increased just 1% 2022.

You still 2025 health insurance. can enroll change plans if have life changes, qualify Medicaid the Children's Health Insurance Program (CHIP). Enter ZIP Code & choose location: Enter ZIP code. Results populate searching. up down arrow keys navigate.

You still 2025 health insurance. can enroll change plans if have life changes, qualify Medicaid the Children's Health Insurance Program (CHIP). Enter ZIP Code & choose location: Enter ZIP code. Results populate searching. up down arrow keys navigate.

/GettyImages-1026036240-4e42f775bd3a498b9579b0e1ae692d6a.jpg) Health insurance costs $7,620 year average an Affordable Care Act (ACA) marketplace plan, based our analysis. cost health insurance the ACA marketplace HealthCare.gov .

Health insurance costs $7,620 year average an Affordable Care Act (ACA) marketplace plan, based our analysis. cost health insurance the ACA marketplace HealthCare.gov .

Get ready apply health coverage; Ways apply health insurance; Preview health insurance plans & prices; help applying health insurance; How apply your income too high the premium tax credit; Complete enrollment & pay first premium; Changing plans you're enrolled

Get ready apply health coverage; Ways apply health insurance; Preview health insurance plans & prices; help applying health insurance; How apply your income too high the premium tax credit; Complete enrollment & pay first premium; Changing plans you're enrolled

Average Health Insurance Cost from. Best Health Insurance Missouri 2025. Les Masterson. Best Health Insurance North Dakota 2025. Les .

Average Health Insurance Cost from. Best Health Insurance Missouri 2025. Les Masterson. Best Health Insurance North Dakota 2025. Les .

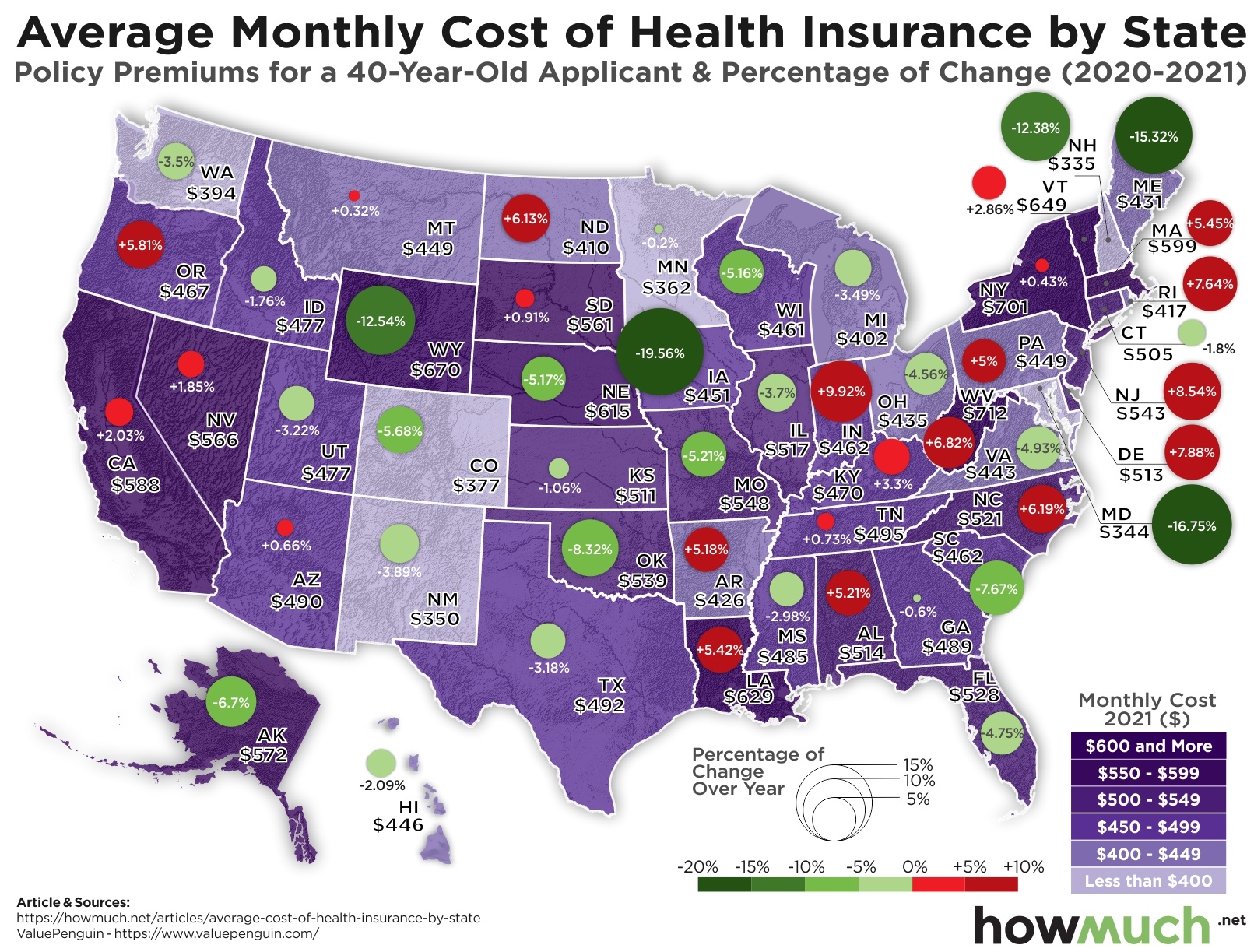

A Silver health insurance plan the ACA marketplace costs average $621 month 2025. That's 7% higher in 2024. 2025, Silver health plan costs $621 month average a 40-year-old. Rates depend things your age, plan tier choose where live. .

A Silver health insurance plan the ACA marketplace costs average $621 month 2025. That's 7% higher in 2024. 2025, Silver health plan costs $621 month average a 40-year-old. Rates depend things your age, plan tier choose where live. .

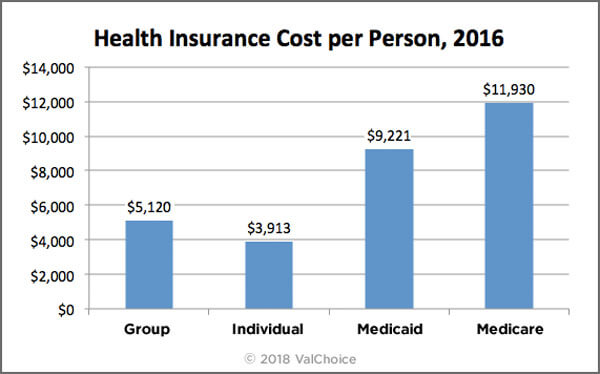

Is health insurance expensive a single person? average, single person pays $117 month employer-sponsored coverage $477 month a plan the health insurance .

Is health insurance expensive a single person? average, single person pays $117 month employer-sponsored coverage $477 month a plan the health insurance .

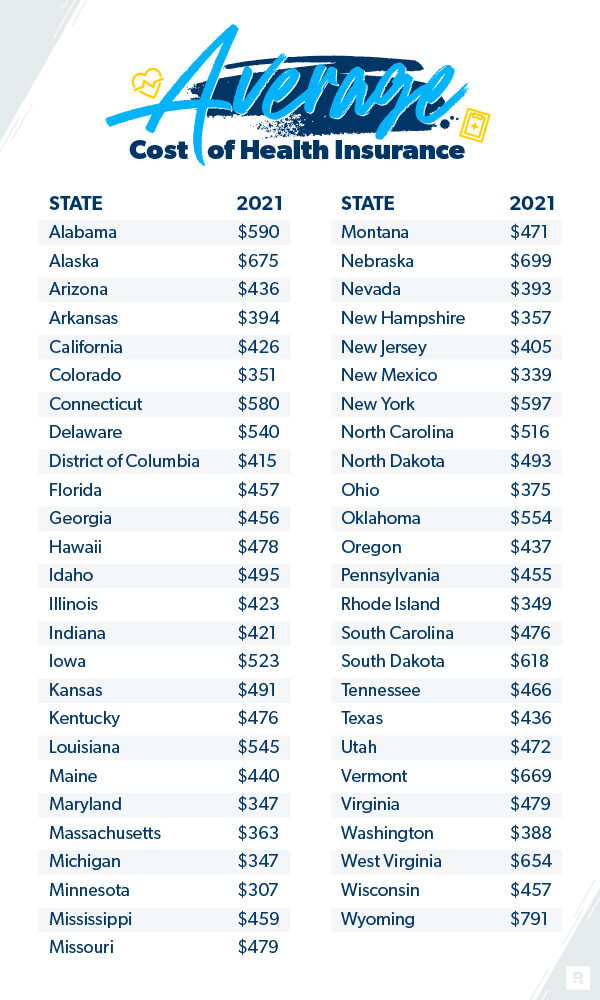

Private health insurance costs include monthly premiums vary significantly depending where live. Virginia the lowest health insurance premiums, a typical 40-year-old paying average $390 month. the end, West Virginia the highest average premiums $864 month. Variation rates stems factors how competition is a .

Private health insurance costs include monthly premiums vary significantly depending where live. Virginia the lowest health insurance premiums, a typical 40-year-old paying average $390 month. the end, West Virginia the highest average premiums $864 month. Variation rates stems factors how competition is a .

The US has the most expensive healthcare system in the world

The US has the most expensive healthcare system in the world

Why Is Health Insurance So Expensive? | Founder's Guide

Why Is Health Insurance So Expensive? | Founder's Guide

Why is health insurance so expensive? New laws play a role - Ramsey

Why is health insurance so expensive? New laws play a role - Ramsey

Why Is Health Insurance So Expensive? | Get a Free Health Insurance Quote

Why Is Health Insurance So Expensive? | Get a Free Health Insurance Quote

Here are the Most & Least Expensive States for Health Insurance

Here are the Most & Least Expensive States for Health Insurance

States With Best Healthcare 2024 - Trish Starlene

States With Best Healthcare 2024 - Trish Starlene

Health Insurance Usa Cost Preview Health Plans And Price Quotes In Your

Health Insurance Usa Cost Preview Health Plans And Price Quotes In Your

Long Term Care Insurance

Long Term Care Insurance

Is Health Insurance Worth the Cost? Because Daaaaaang, It's Expensive

Is Health Insurance Worth the Cost? Because Daaaaaang, It's Expensive