Virginia Drivers Saving 55-75% Car Insurance. Low Reasonable Rates Now. Start Free Online Quote Save to $658. Find Cheap Liability Collision Insurance.

Discover How Much Could Save Auto Insurance Month. have helped 5 Million+ Auto-Owners Compare Top Insurance Plans

Discover How Much Could Save Auto Insurance Month. have helped 5 Million+ Auto-Owners Compare Top Insurance Plans

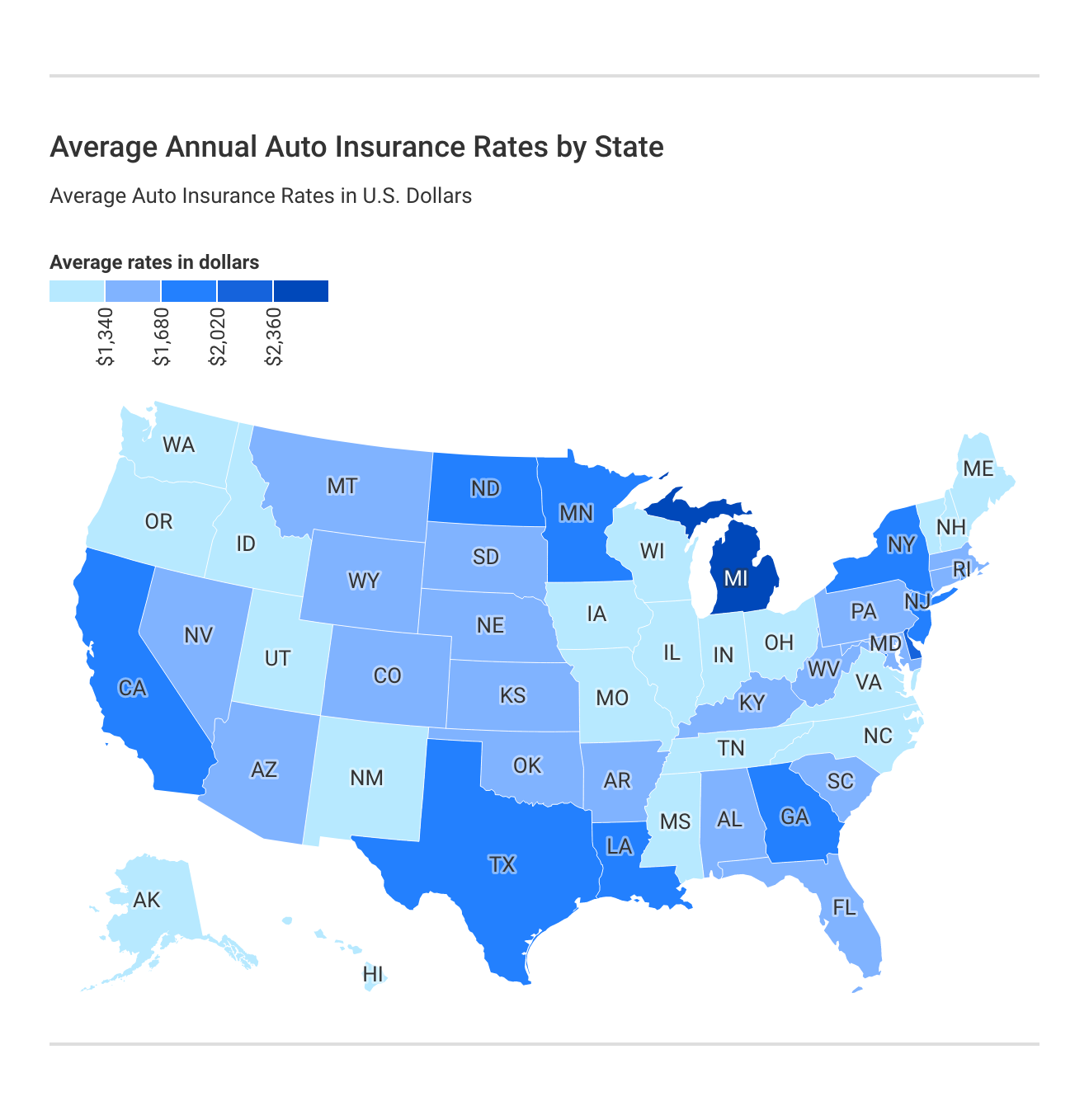

Where live greatly impacts how much pay car insurance. example, Nevada, most expensive state car insurance, full coverage insurance costs $183 per month in cheapest state, Maine. . Car insurance rates differ an average $245 month full coverage one company the next. quote .

Where live greatly impacts how much pay car insurance. example, Nevada, most expensive state car insurance, full coverage insurance costs $183 per month in cheapest state, Maine. . Car insurance rates differ an average $245 month full coverage one company the next. quote .

How much I pay car insurance month? average cost full coverage car insurance is $220 month as January 2025. liability-only minimum coverage, national average .

How much I pay car insurance month? average cost full coverage car insurance is $220 month as January 2025. liability-only minimum coverage, national average .

Estimate car insurance cost your state based how much coverage will by Forbes Advisor's Car Insurance Calculator.

Estimate car insurance cost your state based how much coverage will by Forbes Advisor's Car Insurance Calculator.

The Zebra's free car insurance calculator estimates rates top companies how much can expect pay auto insurance. Skip content . average cost car insurance is $147 month, making $100 month than average. Still, answer depends the type coverage you getting. $100 liability .

The Zebra's free car insurance calculator estimates rates top companies how much can expect pay auto insurance. Skip content . average cost car insurance is $147 month, making $100 month than average. Still, answer depends the type coverage you getting. $100 liability .

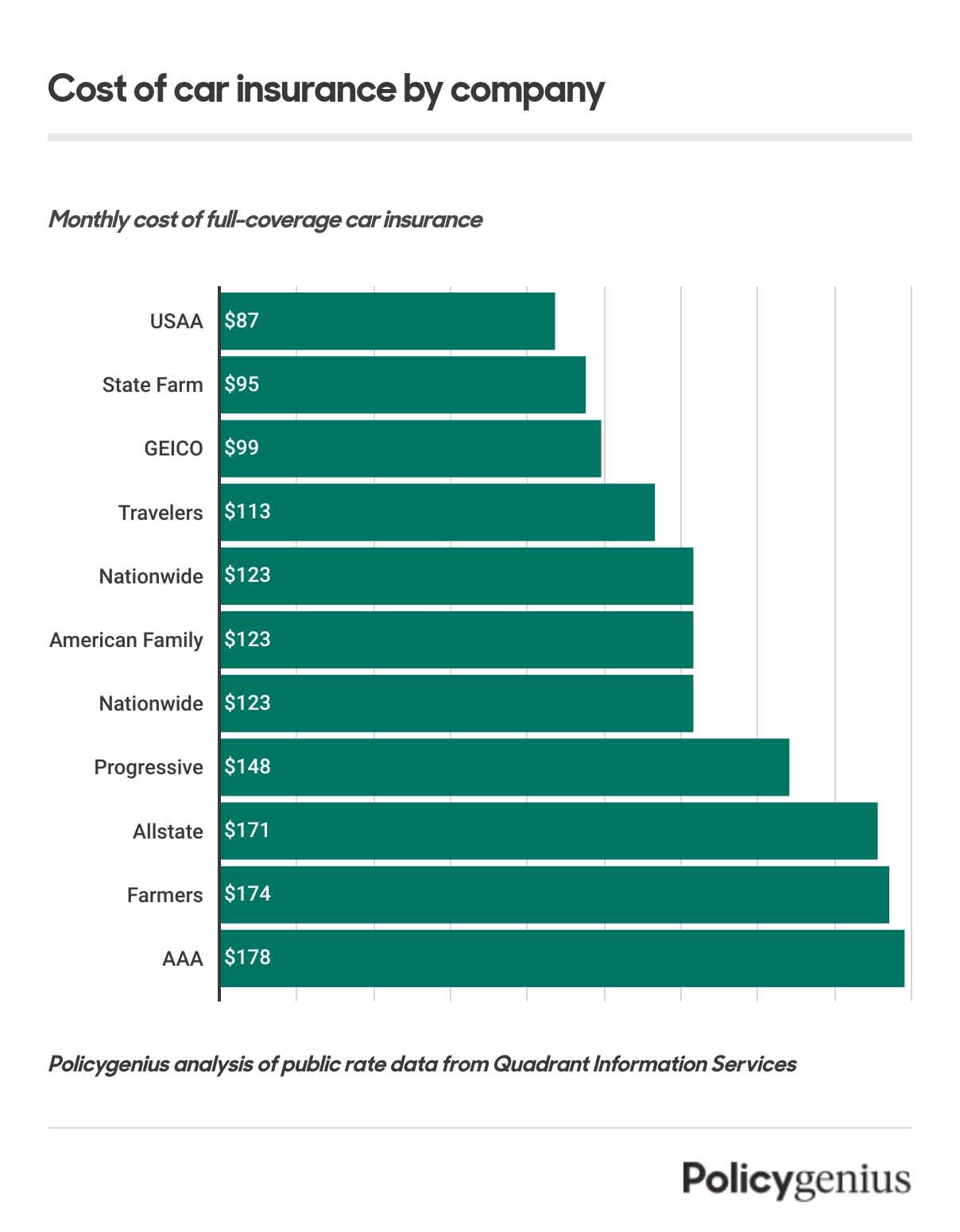

Find how much car insurance costs average your state, city, ZIP code. Compare rates shop affordable car insurance today Policygenius.

Find how much car insurance costs average your state, city, ZIP code. Compare rates shop affordable car insurance today Policygenius.

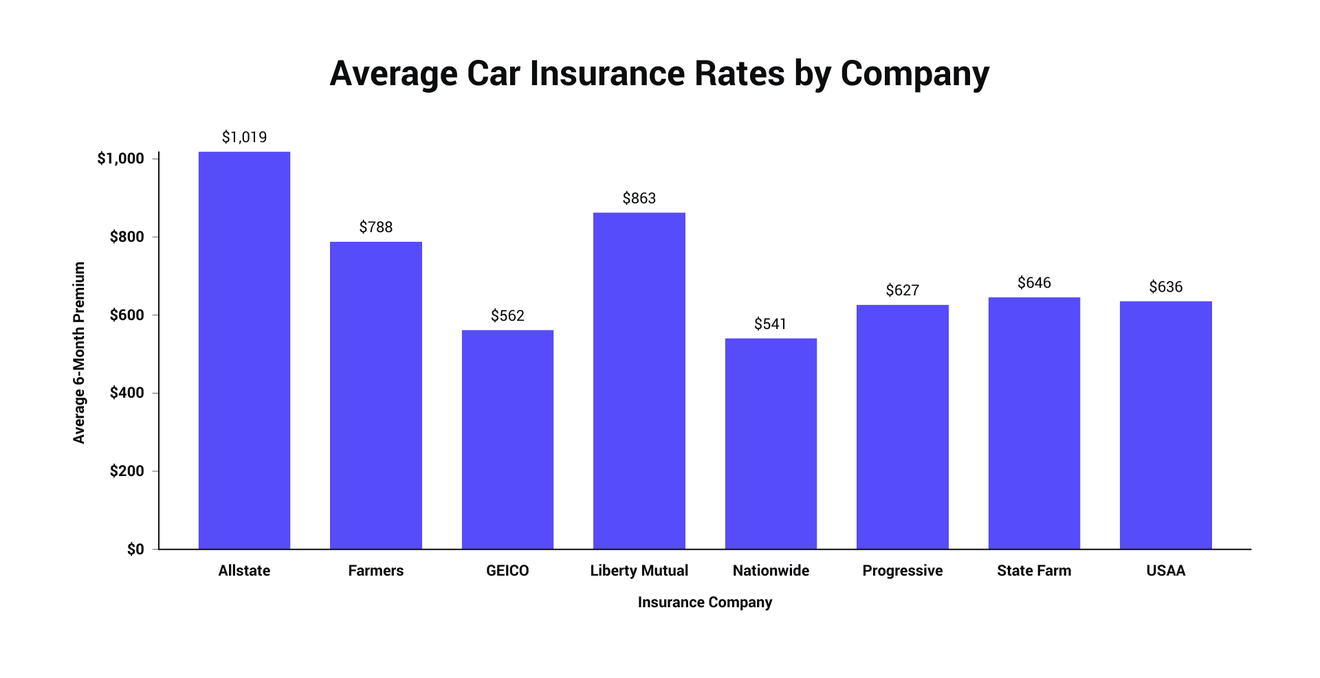

On average, car insurance some the top insurance carriers the nation ranges around $1,500 $2,900 year full coverage, some the cheapest rates coming Auto .

On average, car insurance some the top insurance carriers the nation ranges around $1,500 $2,900 year full coverage, some the cheapest rates coming Auto .

The national average cost car insurance is $2,026 year $169 month, to Forbes Advisor's analysis full coverage rates. national average state minimum coverage .

The national average cost car insurance is $2,026 year $169 month, to Forbes Advisor's analysis full coverage rates. national average state minimum coverage .

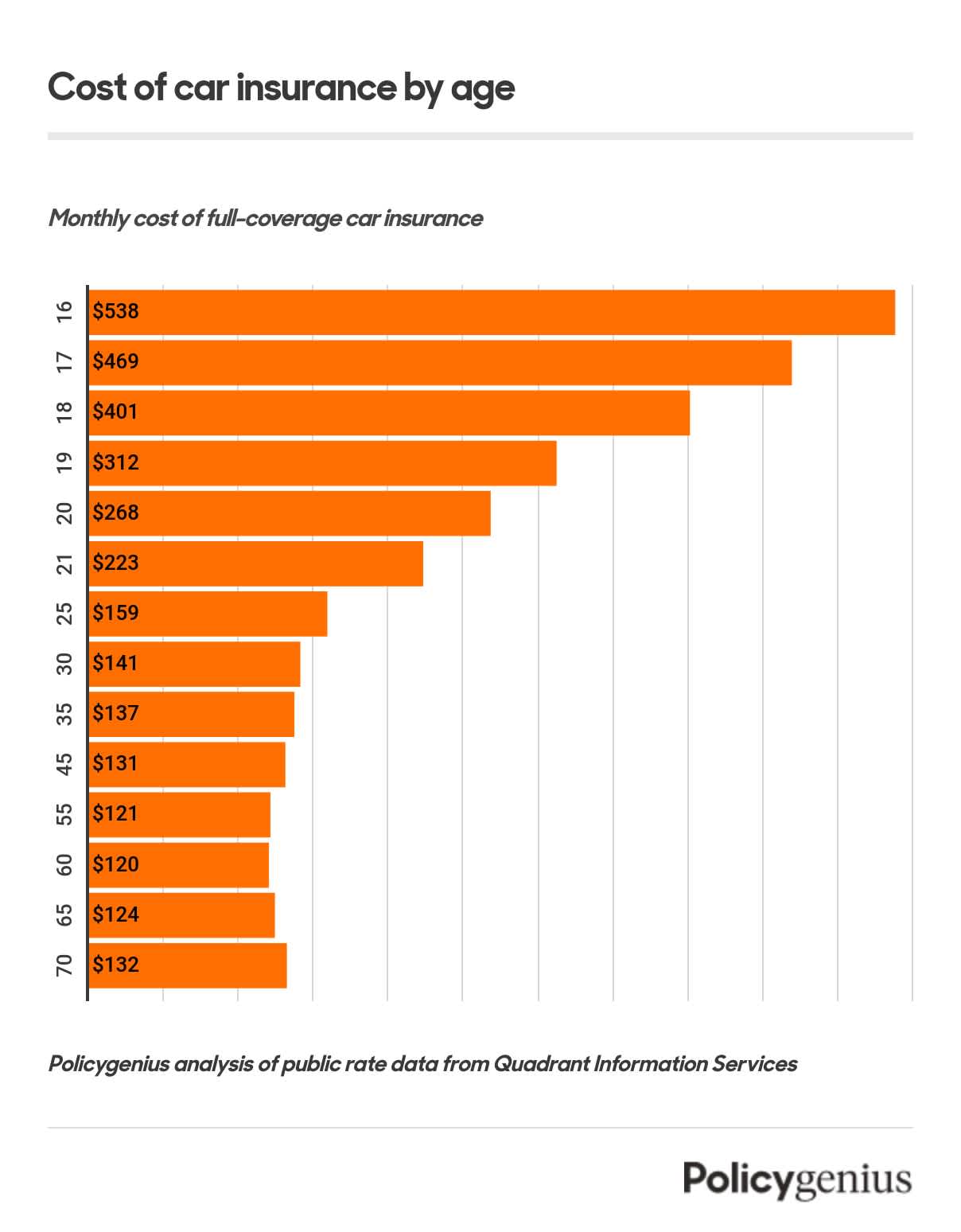

Use car insurance calculator get idea how much car insurance will each month a full car insurance coverage policy 100/300/100 liability limits comprehensive collision coverage, $100,000 for bodily injury person, $300,000 for bodily injury accident $100,000 property damage.

Use car insurance calculator get idea how much car insurance will each month a full car insurance coverage policy 100/300/100 liability limits comprehensive collision coverage, $100,000 for bodily injury person, $300,000 for bodily injury accident $100,000 property damage.

Car insurance is a crucial aspect responsible vehicle ownership, offering protection financial security case accidents unexpected events. can tricky know what types auto insurance coverage need, how much get. Luckily, free car insurance calculator help determine amount might and provide insight potential costs.

Car insurance is a crucial aspect responsible vehicle ownership, offering protection financial security case accidents unexpected events. can tricky know what types auto insurance coverage need, how much get. Luckily, free car insurance calculator help determine amount might and provide insight potential costs.

Auto insurance premiums quoted either 6-month annual policy periods. $2,504 $209 month- that's extra $50 month the average. a at table to how items your driving record affect car insurance premiums.

Auto insurance premiums quoted either 6-month annual policy periods. $2,504 $209 month- that's extra $50 month the average. a at table to how items your driving record affect car insurance premiums.

:max_bytes(150000):strip_icc()/how-much-does-car-insurance-cost-5072100_final-915c31d331c9435085f258da3e1e1852.png) How Much Does Car Insurance Cost?

How Much Does Car Insurance Cost?

Monthly Car Insurance Calculator - Auto Insurance Calculator : Car

Monthly Car Insurance Calculator - Auto Insurance Calculator : Car

Average Cost Of Car Insurance 2023 - Forbes Advisor

Average Cost Of Car Insurance 2023 - Forbes Advisor

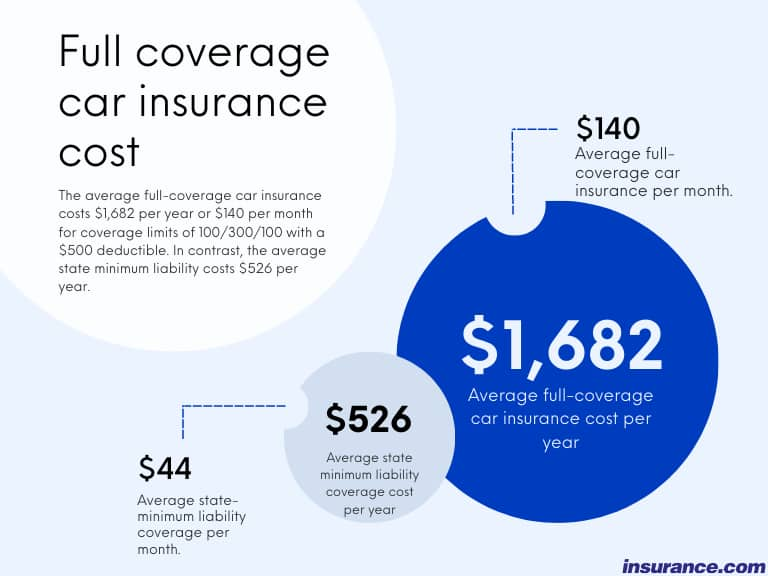

Full coverage car insurance cost in 2024

Full coverage car insurance cost in 2024

How Much Is Car Insurance Per Month? - Insurance Noon

How Much Is Car Insurance Per Month? - Insurance Noon

Average Cost of Car Insurance (2024) - Policygenius

Average Cost of Car Insurance (2024) - Policygenius

How Much Does Car Insurance Cost on Average? | The Zebra

How Much Does Car Insurance Cost on Average? | The Zebra

The Average Cost of Car Insurance in the US | Car RC

The Average Cost of Car Insurance in the US | Car RC