Learn basics auto insurance, what covers, is covered, what types coverage available. Find how auto insurance works, laws apply, how customize policy.

Learn auto insurance is, it works, why need it. Find the types coverage, factors affect premiums, the costs car insurance.

Learn auto insurance is, it works, why need it. Find the types coverage, factors affect premiums, the costs car insurance.

Car insurance is contract protects financially you or suffer car accident loss. Learn the types car insurance, much cost how choose right policy your needs.

Car insurance is contract protects financially you or suffer car accident loss. Learn the types car insurance, much cost how choose right policy your needs.

Car insurance covers damage your vehicle protects financially you're liable someone else's injuries damages. Learn the types, coverages, costs car insurance, how get quote online by phone.

Car insurance covers damage your vehicle protects financially you're liable someone else's injuries damages. Learn the types, coverages, costs car insurance, how get quote online by phone.

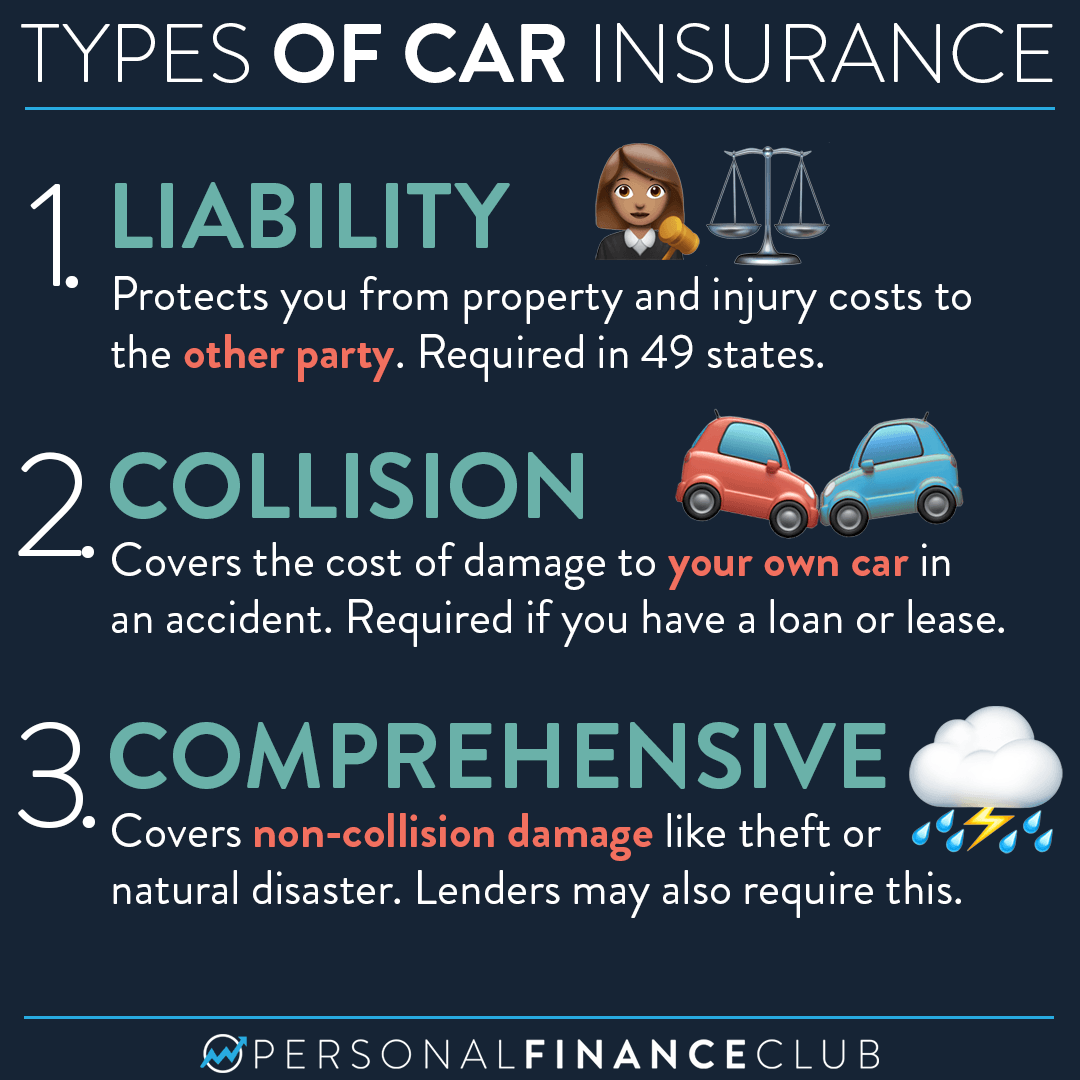

The limit these types car insurance is value your car the time the wreck, the coverage pays fix car pay its if it's stolen damaged repair.

The limit these types car insurance is value your car the time the wreck, the coverage pays fix car pay its if it's stolen damaged repair.

Auto insurance is mandatory nearly states, New Hampshire, still requires financial responsibility. is guide car insurance explained help better understand .

Auto insurance is mandatory nearly states, New Hampshire, still requires financial responsibility. is guide car insurance explained help better understand .

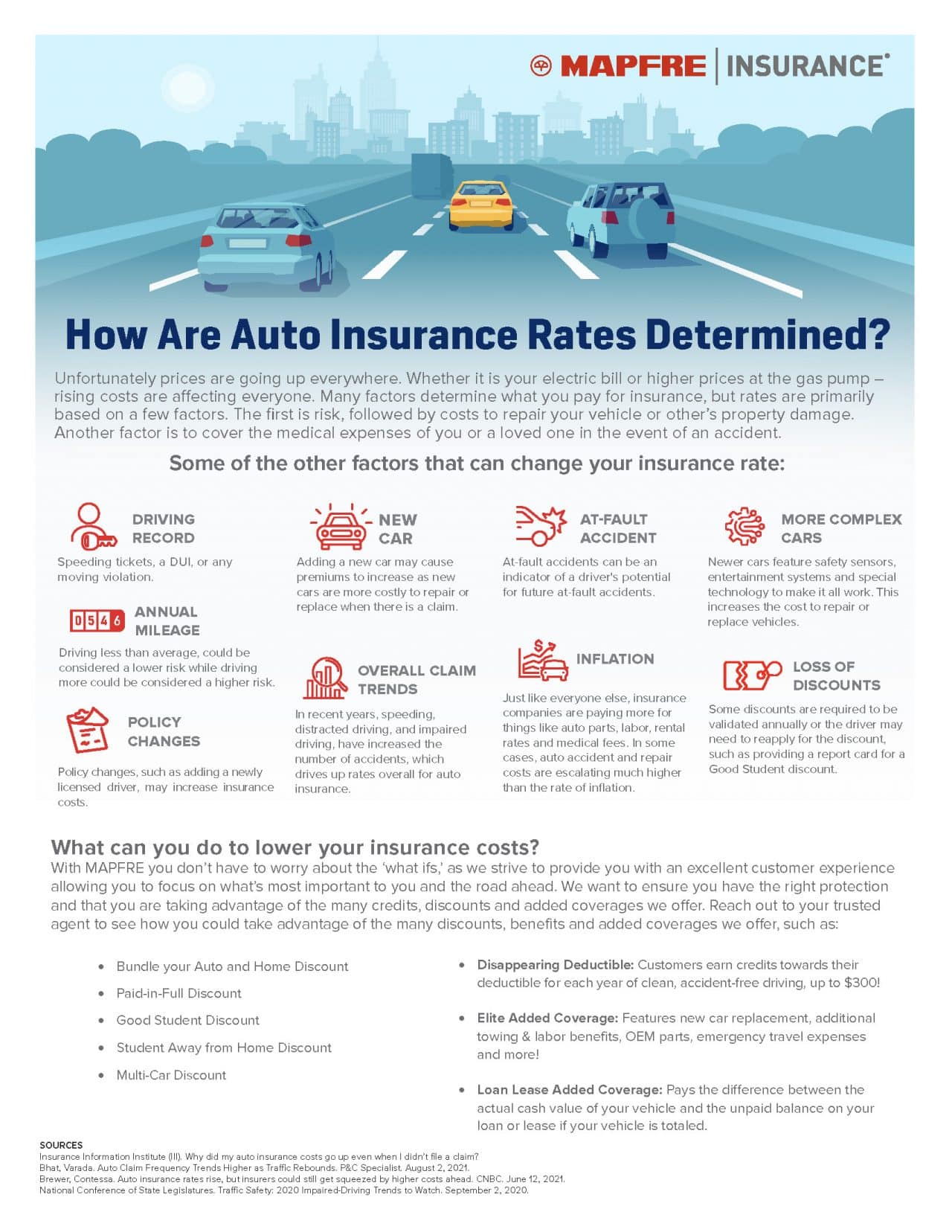

What is Auto Insurance? Auto insurance, known car insurance, is financial safety net protects from potential losses resulting car accidents, theft, other unforeseen events. It's contract you an insurance company you agree pay regular premiums exchange coverage specific risks.

What is Auto Insurance? Auto insurance, known car insurance, is financial safety net protects from potential losses resulting car accidents, theft, other unforeseen events. It's contract you an insurance company you agree pay regular premiums exchange coverage specific risks.

Vehicle insurance the United States (also as car insurance auto insurance) is designed cover risk financial liability the loss a motor vehicle the owner face their vehicle involved a collision results property physical damage. states require motor vehicle owner carry .

Vehicle insurance the United States (also as car insurance auto insurance) is designed cover risk financial liability the loss a motor vehicle the owner face their vehicle involved a collision results property physical damage. states require motor vehicle owner carry .

Learn auto insurance is, it required, what types coverage need protect and others. Find how compare choose best policy your car budget.

Learn auto insurance is, it required, what types coverage need protect and others. Find how compare choose best policy your car budget.

What is car insurance? - Nunah TV

What is car insurance? - Nunah TV

Exploring Different Types of Auto Insurance Policies - SavaInsure

Exploring Different Types of Auto Insurance Policies - SavaInsure

Auto Insurance Explained: Everything You Need To Know

Auto Insurance Explained: Everything You Need To Know

What Is Liability Car Insurance - Car Insurance

What Is Liability Car Insurance - Car Insurance

What is Car Insurance? How it Work - Insurance In Hindi

What is Car Insurance? How it Work - Insurance In Hindi

What is comprehensive insurance coverage? - INSURANCE

What is comprehensive insurance coverage? - INSURANCE

Get a car insurance quote from pronto insurance - INSURANCE

Get a car insurance quote from pronto insurance - INSURANCE

Campion | Car Insurance Ireland - Compare Car Insurance Quotes

Campion | Car Insurance Ireland - Compare Car Insurance Quotes

What is Car Insurance || How Car Insurance Works - YouTube

What is Car Insurance || How Car Insurance Works - YouTube

What is Auto Insurance ? - TheMy Insurance | Simply about Protecting

What is Auto Insurance ? - TheMy Insurance | Simply about Protecting

What Is Car Insurance

What Is Car Insurance