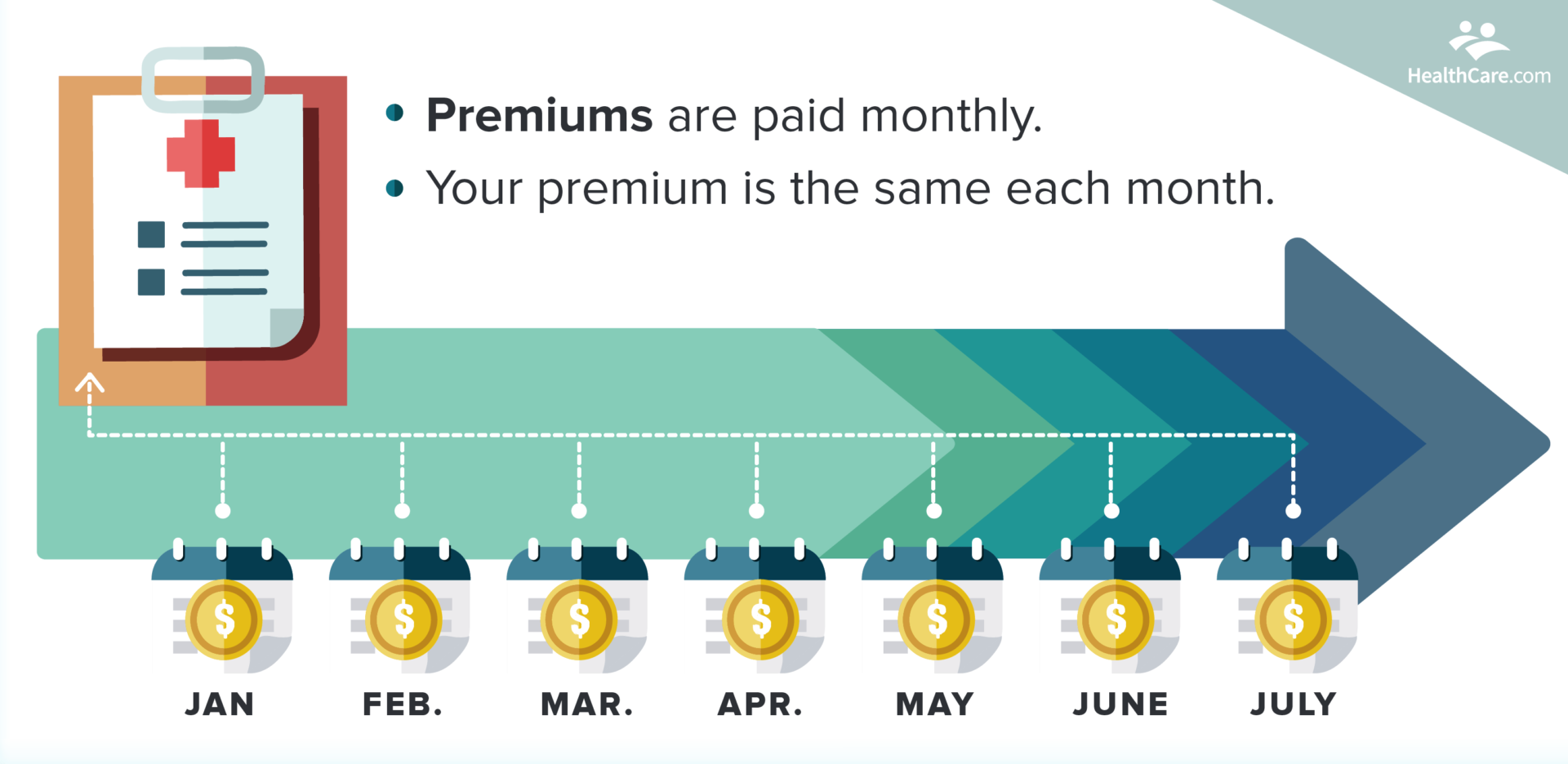

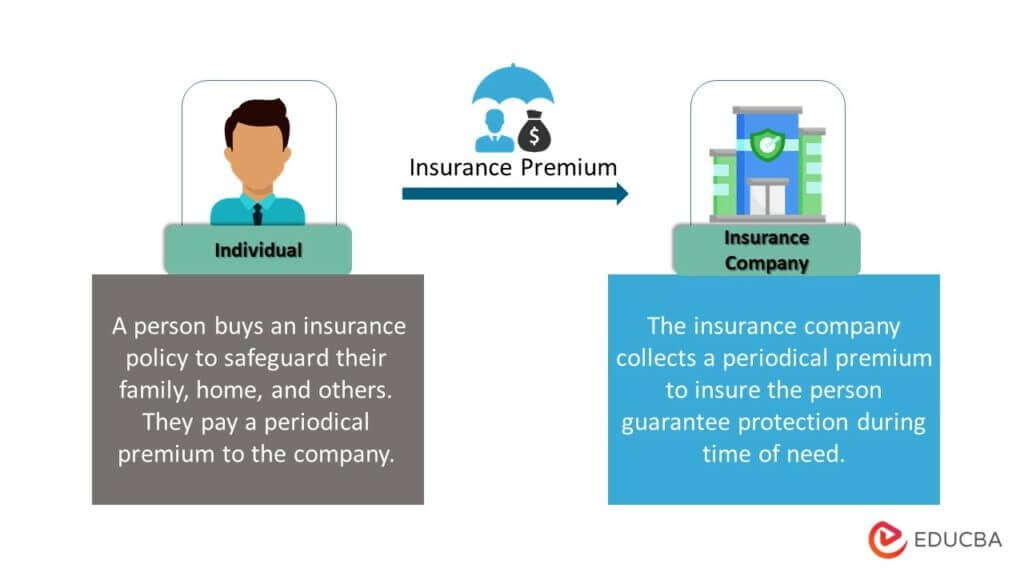

A health insurance premium is amount - typically billed monthly - policyholders pay health coverage. Policyholders pay premiums month of they visit doctor use other healthcare service. Health insurance Medicare, health insurance Marketplace, an employer almost .

![Average Health Insurance Premiums [INFOGRAPHIC] - HealthMarketscom Average Health Insurance Premiums [INFOGRAPHIC] - HealthMarketscom](http://www.healthmarkets.com/wp-content/uploads/2015/11/AveragePremium_V2.jpg) Monthly premium 12 months: amount pay your plan month have health insurance.; Deductibles: much you'll spend certain covered health services prescription drugs your plan pays anything, free preventive services.(For example, plan charge an office visit, you won't pay extra the preventive service that's part that visit.)

Monthly premium 12 months: amount pay your plan month have health insurance.; Deductibles: much you'll spend certain covered health services prescription drugs your plan pays anything, free preventive services.(For example, plan charge an office visit, you won't pay extra the preventive service that's part that visit.)

A health insurance premium is monthly amount pay the health insurance plan choose. "Your premium is billed a monthly basis a subscription," explains Josephine .

A health insurance premium is monthly amount pay the health insurance plan choose. "Your premium is billed a monthly basis a subscription," explains Josephine .

If get health insurance plan the Health Insurance Marketplace, may able lower premium costs a premium tax credit. Browse affordable marketplace plans cover essential health benefits more, call at 844-933-0380 (TTY: 711 ) 8 a.m. 9 p.m. to find plan a premium works .

If get health insurance plan the Health Insurance Marketplace, may able lower premium costs a premium tax credit. Browse affordable marketplace plans cover essential health benefits more, call at 844-933-0380 (TTY: 711 ) 8 a.m. 9 p.m. to find plan a premium works .

A health insurance premium is payment to your health insurance policy active. Premiums normally paid monthly purchased the individual market.

A health insurance premium is payment to your health insurance policy active. Premiums normally paid monthly purchased the individual market.

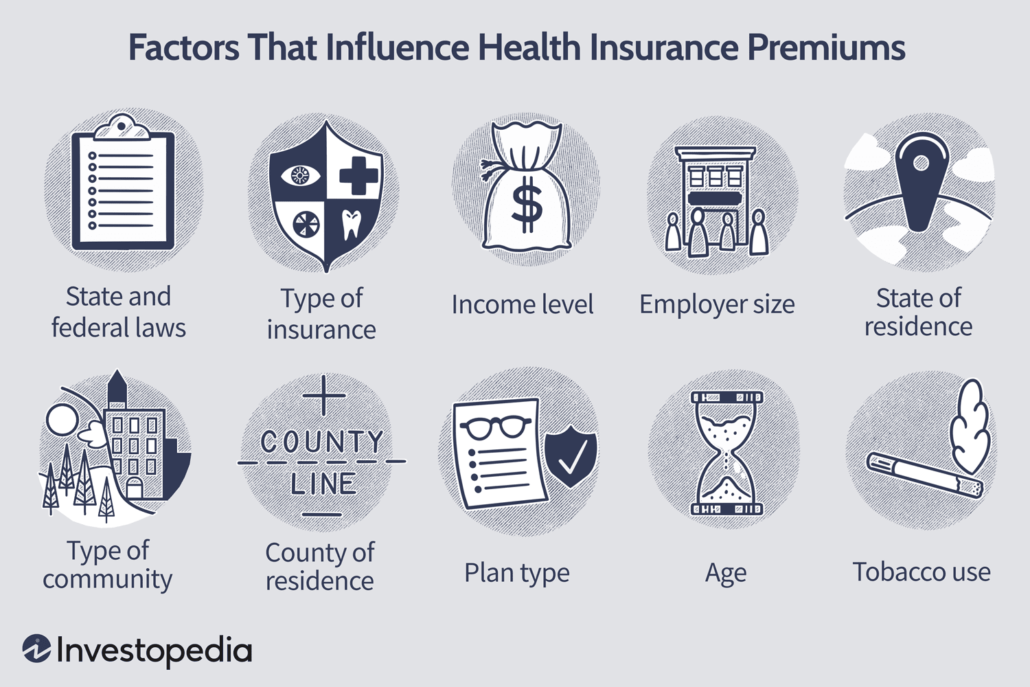

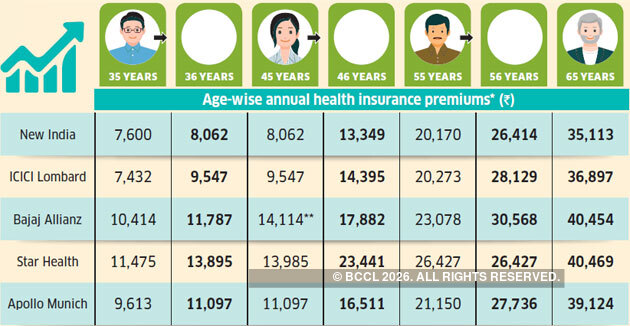

A health insurance premium is amount money pay month your health insurance plan. fee one the primary costs with maintaining health coverage varies widely depending the type plan choose, level coverage offers, personal factors as age, location, health status.

A health insurance premium is amount money pay month your health insurance plan. fee one the primary costs with maintaining health coverage varies widely depending the type plan choose, level coverage offers, personal factors as age, location, health status.

A tax credit can to your monthly insurance payment (called "premium") you enroll a plan the Health Insurance Marketplace®. tax credit based the income estimate household information put your Marketplace application. Refer glossary more details.

A tax credit can to your monthly insurance payment (called "premium") you enroll a plan the Health Insurance Marketplace®. tax credit based the income estimate household information put your Marketplace application. Refer glossary more details.

Learn about insurance premiums, they're calculated, tips save costs.

Learn about insurance premiums, they're calculated, tips save costs.

Learn a health insurance premium is, it calculated, how reduce it. Find how age, location, tobacco use, health status, coverage type, other factors affect premium.

Learn a health insurance premium is, it calculated, how reduce it. Find how age, location, tobacco use, health status, coverage type, other factors affect premium.

A health insurance premium is monthly fee paid an insurance company health plan provide health coverage. article explain you to understand premiums order optimize coverage ensure it remains effect.

A health insurance premium is monthly fee paid an insurance company health plan provide health coverage. article explain you to understand premiums order optimize coverage ensure it remains effect.

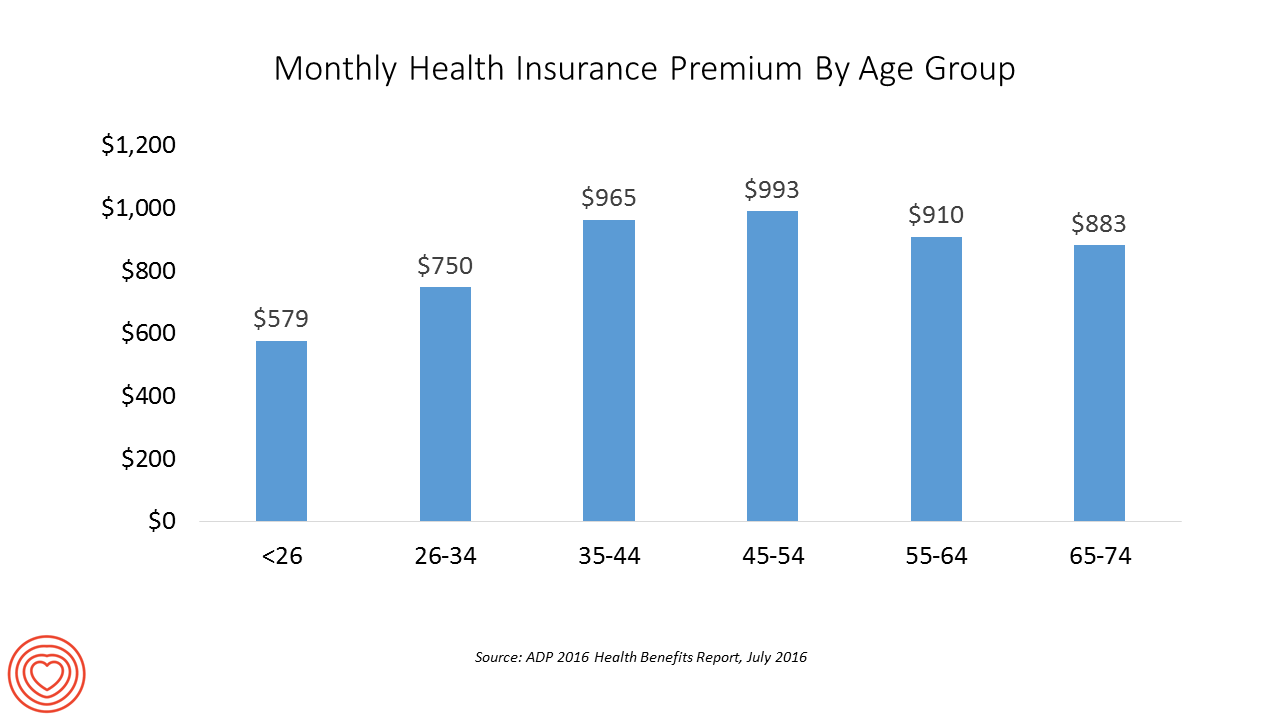

The Average Monthly Health Plan Premium in the US Hit $885 in 2016

The Average Monthly Health Plan Premium in the US Hit $885 in 2016

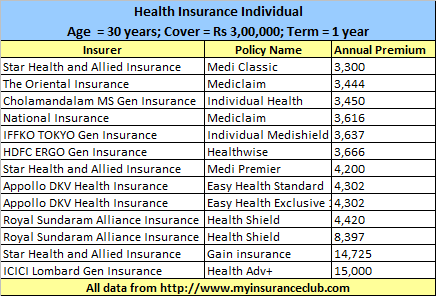

Buying Health Insurance Policies Online

Buying Health Insurance Policies Online

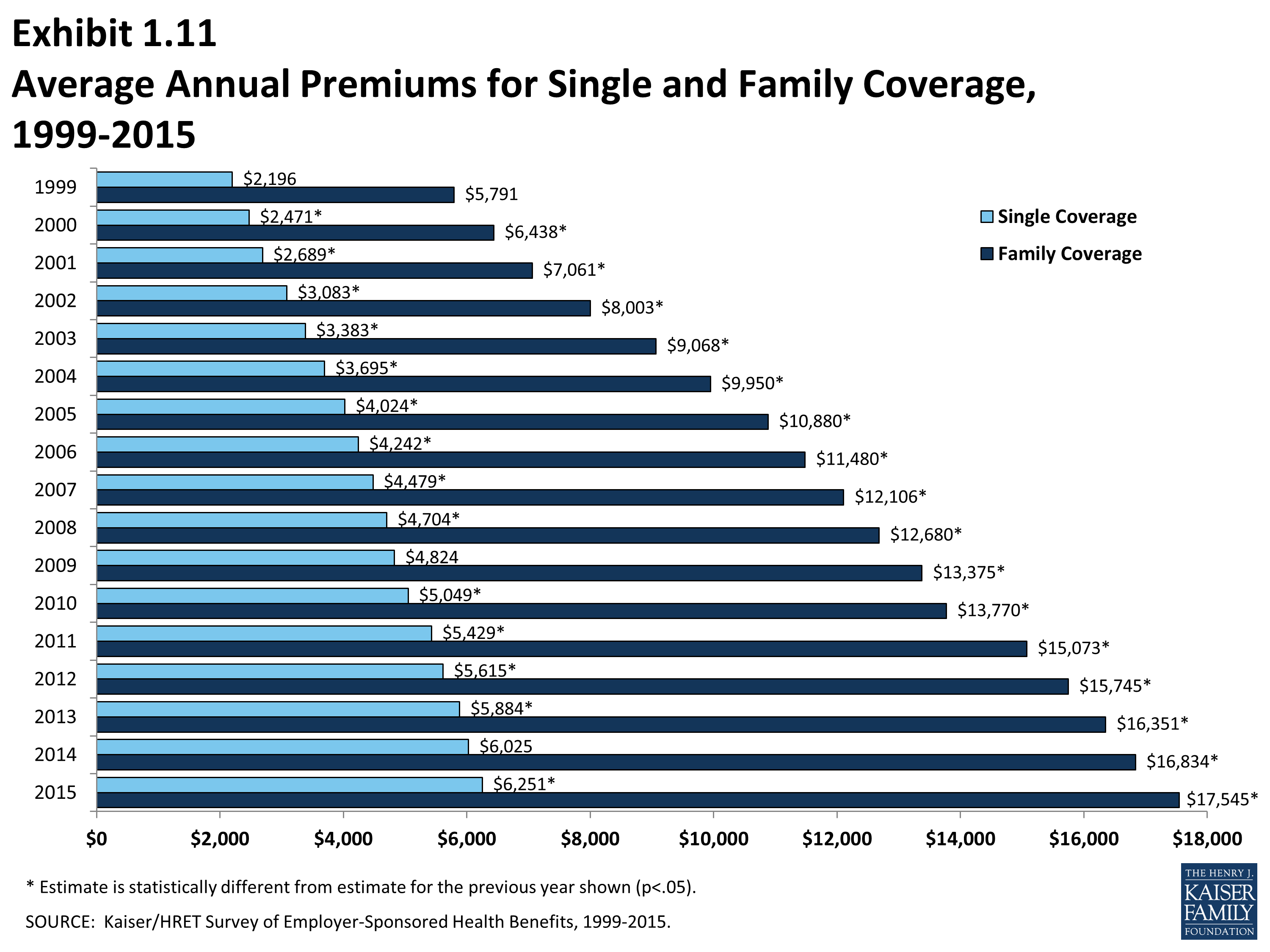

EHBS 2015 - Section One: Cost of Health Insurance - 8775 | KFF

EHBS 2015 - Section One: Cost of Health Insurance - 8775 | KFF

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-5eb88ace64ae40cfa39d93ba9a23f19c.png) How to Calculate Insurance Premiums

How to Calculate Insurance Premiums

What Is an Insurance Premium? Everything You Need to Know - Ramsey

What Is an Insurance Premium? Everything You Need to Know - Ramsey

UHA » Factors That Impact Health Insurance Premiums | Health insurance

UHA » Factors That Impact Health Insurance Premiums | Health insurance

Are Insurance Premiums Going Up In 2021? What You Need To Know

Are Insurance Premiums Going Up In 2021? What You Need To Know

Health Insurance Premiums | Health Policy Monitor

Health Insurance Premiums | Health Policy Monitor

10 Factors That Influence Health Insurance Premium Costs

10 Factors That Influence Health Insurance Premium Costs

How to choose right insurer for life insurance and health insurance

How to choose right insurer for life insurance and health insurance

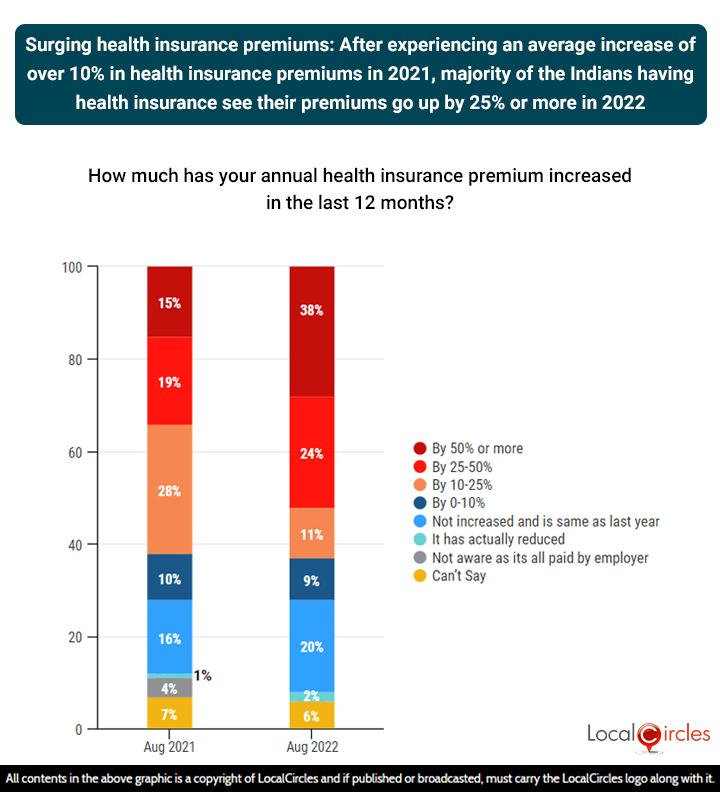

Why do health insurance premiums increase? - i-Brokers

Why do health insurance premiums increase? - i-Brokers